- Fully Regulated

- Expertly Reviewed

- Secure & Trusted

- Transparent Fees

- Mobile Friendly

Find The Best Broker For Your Trading Level.

NASDAQ forex Brokers

Cryptocurrency Trading platforms

Volitality 75 Forex Brokers

How to Buy Bitcoin

Forex Trading Brokers in Uganda

We explore everything from A -Z how to become a skillful trader and who are the best forex brokers in Uganda for your style of trading.

For Ugandan Investors, forex trading can be a way to diversify.

Quick Content

Best Forex Brokers in Uganda

Forex Trading

Basics

Forex

Terminology

Currency

Pairs

How to Start Trading in Uganda ?

Forex Trading

Strategies

Forex

Charting

Forex Trading Risk Management

Forex Trading Platforms

Pros and Cons of Forex Trading

Top 10 Best Forex Brokers in Uganda

| 🥇 Forex Broker | 👨🏿 Accepts Ugandan Traders | ⚖️ Regulation | 📈 Leverage | 💰 Minimum Deposit | 🔒 Open an account |

| 1. Exness | ✔️ Yes | FSCA, FSA, CySEC, FCA, CBCS, FSC (BVI), FSC (Mauritius) | 1:Unlimited | 4158 Ugandan Shilling | 👉 Click Here |

| 2. Trade Nation | ✔️ Yes | FCA, ASIC, FSCA, SCB | 1:200 | 0 Ugandan Shilling | 👉 Click Here |

| 3. AvaTrade | ✔️ Yes | Central Bank of Ireland (CBI), BVI FSC, ASIC, FSCA, JFSA, FFAJ, ADGM, FRSA, CySEC, ISA | 1:30 | 41 577 Ugandan Shilling | 👉 Click Here |

| 4. Hotforex | ✔️ Yes | CySEC, FSC, CFTC | 1:500 | 2079 Ugandan Shilling | 👉 Click Here |

| 5. FBS | ✔️ Yes | IFSC, FSCA (South Africa), ASIC, CySEC | 1:3000 | 416 Ugandan Shilling | 👉 Click Here |

| 6. Alpari | ✔️ Yes | FSC | 1:25 | 41 577 Ugandan Shilling | 👉 Click Here |

| 7. eToro | ✔️ Yes | CySec, FCA | 1:100 | 415 770 Ugandan Shilling | 👉 Click Here |

| 8. JustMarkets | ✔️ Yes | FSA | 1:3000 | 41 577 Ugandan Shilling | 👉 Click Here |

| 9. XM | ✔️ Yes | IFSC, CySec, ASIC | 1:500 | 41 577 Ugandan Shilling | 👉 Click Here |

| 10. IG | ✔️ Yes | IGRs | 1:50 | 0 Ugandan Naira | 👉 Click Here |

The following forex brokers are the best 19 options for Ugandan Traders:

- Trade Nation -️ Best Forex Broker Uganda

- eToro️ – Best Online Social Trading Platform in Uganda

- FXTM (Forextime) – Best Ugandan Naira Account

- Exness – Best Variety of Retail Investor Accounts

- InstaForex – Best No Deposit Forex Bonus in Uganda

- AvaTrade – Best Range of Tradable Instruments in Uganda

- XM – Lowest Spreads in the Trading Industry in Uganda

- FBS – Highest Maximum Leverage offered in Uganda

- HotForex – Best Bonus Offers and Cheapest Deposits in Uganda

- Alpari – Best Ugandan-based Forex Broker

- OctaFX – Best Analytics and Education in Uganda

- IG – Best Ugandan ETFs Broker

- Plus500 – Best CFD Trading Broker in Uganda

- LiteFinance – Best Islamic Account

- RoboForex – Best Ugandan Naira Deposits

- JustMarkets – Lowest Minimum Deposit

- Superforex – Low Spread Forex brokers in Uganda

- 7B Forex – Broker with local offices in Lagos. Uganda

- Tifia – Best Niara Low Spread Trading Account

👉 You’ll learn all you need to know about being a great trader and which forex brokers in Uganda are best suited for your style of trading in this comprehensive guide. Ugandan traders can easily take advantage of the competitive, exciting environment offered by forex trading as it is accessible to all over the age of 18.

➡️ Despite its popularity, forex trading remains uncontrolled in Uganda.

➡️ The Uganda Capital Markets Authority (CMA) supports and controls the growth of the capital market by overseeing and monitoring licensed brokers, investment advisors, and Fund Managers, among other regulatory tasks.

➡️ The Ugandan CMA has not yet awarded a license to any forex broker that operates in the country. This does not mean that forex trading is illegal, it only means that Ugandans must use regulated international/offshore brokers to connect to the financial markets.

➡️ While forex trading can be inexpensive overall, it could become costly for Ugandan traders because of the exchange rates between UGX and other currencies. To register an account with a forex broker, Ugandans need capital between 3,700 UGX to 18,000 UGX, and even up to 370,000 UGX (the equivalent of $100).

➡️ The purpose of the UFBMRA’s introduction of the forex trading Code of Conduct was to serve as a roadmap for the forex bureau to follow to guarantee high ethical standards and fair play while doing business.

👉 How profitable is forex trading for individuals and retail traders? How much do you need to start trading forex in Uganda? Can you keep your full-time job while you trade forex part-time? What are the significant risks involved with trading forex in Uganda?

👉 These are just a few questions that many Ugandan traders may have as beginner forex traders. Explore our website to find the answers to these questions and more.

👉 Foreign Exchange Trading is a legal activity in Uganda that is governed by the Capital Markets Authority (CMA) of Uganda. While the Ugandan CMA does not officially regulate forex brokers who carry out financial activities, regulators such as the FSCA, FCA, CySEC, and others, provide Ugandans with protection.

👉 We reveal the best brokers with verified regulations who offer their services locally in Uganda. Ugandans can rest assured that these are trusted and legitimate brokers that garner a high trust score and/or rating.

Forex Trading Pros and Cons

| ✔️ Pros | ❌ Cons |

| Forex trading has the benefit of cross-border trading without limitations | A currency exchange rate that fluctuates often might be a disadvantage since variables such as economic and political impact can lead to market pricing instability |

| Because of the FX market’s worldwide reach, it can operate around the clock, Monday through Friday, every week | Because of the lack of a central regulator or exchange to establish base prices, there are wide variances in pricing among brokers in the spot market |

| The number of individuals who can participate in forex trading is growing at an accelerating rate | Traders can enter forex transactions at minimal prices, but they could be exposed to greater losses if the exchange rate fluctuates |

| There are also reduced capital requirements and transaction costs involved with purchasing and selling currency values when trading in FX markets | To trade with more money than you originally deposit, you might utilize leverage in Forex trading. Leverage necessitates paying interest on the money borrowed |

| There will be less price manipulation in the forex market because of the substantial number of traders and liquidity, therefore the rates offered by your broker will be extremely near to the interbank rate | International news, economic developments, as well as other external factors, may have an enormous impact on currency exchange rates in a turbulent and competitive forex market |

| One of the most attractive aspects of forex trading is the ability to employ leverage If you can profit from a lot of market activity, you will find forex trading to be both fascinating and lucrative | In contrast to other markets, forex traders must study trading strategies on their own |

| Because of the 24/5 trading hours, short-term traders benefit since it allows them to trade at their own leisure |

Step-by-Step on How to Start Trading Forex in Uganda

➡️ Step 1 – Learn about Forex Trading

➡️ Step 2 – Set up a trading account with a broker

➡️ Step 3 – Register a Demo Account with A Broker of Your Choice

➡️ Step 4 – Choose your trading platform

➡️ Step 5 – Choose a Currency Pair

➡️ Step 6 – Develop a Trading Strategy

➡️ Step 7 – Use Your Demo Account to Practise Trading

➡️ Step 8 – Analyse the Forex Market

➡️ Step 9 – Read the Quote and Choose a Position to start trading

➡️ Step 10 – Always control your emotions and stay on top of the numbers

✅ Step 1 – Learn about Forex Trading

👉 Forex trading is a project and calls for specialist expertise, even though it is not extremely hard.

👉 For instance, the leverage ratio for foreign exchange trading is larger than that for stock trades, and the factors that influence the movement of currency prices are distinct from those that influence the movement of equity market prices.

👉 Beginners may choose from several different online courses that provide instruction on the fundamentals of currency trading.

✅ Step 2 – Set up a trading account with a broker

👉 To get started with foreign exchange trading, you will need to open a trading account with a brokerage that specializes in that market.

👉 Commissions are not something that forex brokers typically charge their clients unless traders are charged zero-pip spreads. Instead, they earn money from the difference in price between buying and selling, which is referred to as the spread or the pip.

👉 If you are just starting trading, it is recommended that you open a micro forex trading account since these accounts have minimal minimum deposit requirements.

👉 These types of accounts have trading restrictions that may vary and enable brokers to set minimum transaction thresholds as low as one thousand of a given currency’s units.

👉 To put this into perspective, a typical account lot is equivalent to 100,000 units of the respective currency. The use of a micro forex account will assist you in becoming more familiar with currency trading and in identifying the trading approach that works best for you.

✅ Step 3 – Register a Demo Account with A Broker of Your Choice

👉 Because you cannot engage in online trading without a broker, making the best choice for your broker is the most important phase in the forex trading process.

👉 If you make the incorrect choice, it might result in a highly negative experience for you throughout your trading career. You need to check that the broker you choose has reasonable commission rates, a good user interface, and most importantly, a sample account.

👉 You will be able to determine whether the broker is a good fit for you by using the demo account.

✅ Step 4 – Choose your trading platform

👉 Some FX brokers may give you a specific piece of software or an app to trade with, while others will provide their own online trading interface. Most firms support the popular MetaTrader trading platform.

👉 If you access the internet with a browser that is not as widely used, you should operate on the assumption that your forex broker does not support that browser.

👉 In this scenario, you will be required to make use of a mobile application or to download and install a popular web browser on the machine you want to use for Forex trading.

✅ Step 5 – Choose a Currency Pair

👉 Trading foreign exchange, or forex, allows Ugandans to exchange the value of a currency for the value of another currency.

👉 To put it another way, you will constantly be purchasing one currency while simultaneously selling another one. Because of this, you will never trade currencies alone; you will only do it in pairs.

👉 With sufficient funds in your account, you could trade any currency pair provided by your broker. However, many novice traders start by trading the pairings of major currencies.

👉 However, if you have enough money in your account, you can trade any currency pair that is offered by your chosen broker. Enough capital is essential as other currency pairs such as minor and exotics tend to be more expensive than major pairs because of lower liquidity in the market.

✅ Step 6 – Develop a Trading Strategy

👉 Even if it is not always feasible to anticipate and time market action, having a trading strategy can assist you in establishing general principles and a trading road map. A solid trading strategy considers the current state of one’s life and financial circumstances.

👉 It considers the quantity of capital that you are prepared to put up for trading and, consequently, the level of risk that you can endure without being burnt out of your position.

👉 Both factors are taken into consideration and Ugandans must remember that most of the time, forex trading takes place in high-leverage environments. However, for those who are prepared to put in the effort, there are also greater potential benefits.

✅ Step 7 – Use Your Demo Account to Practise Trading

👉 Demo trading does offer certain advantages, one of which is that it enables novice traders to get a broad understanding of how the market and a company’s software function.

👉 Demo accounts may be of some value to novice traders since they enable the trader to grow used to trading software and gain an understanding of how the market operates. This can be of some benefit to new traders.

👉 We propose that you sign up for a demo account so that you can get some practice trading forex without having to worry about losing any money. Therefore, you will not have to worry about losing money as you gain expertise in trading forex.

✅ Step 8 – Analyse the Forex Market

👉 Your efforts in trading should start with a solid foundation built on research and analysis. When you lack them, you are forced to rely on your emotions. In most cases, things do not turn out that well in the end.

👉 When you first begin your investigation, you will discover a vast number of materials on foreign exchange, which may first seem to be daunting. However, when you research a certain currency pair, you will discover useful resources that stand out from the rest of the options.

👉 You should routinely undertake a variety of technical and fundamental analyses, such as looking at historical and current charts, keeping an eye on the news for any economic developments, checking various indicators, and so on.

✅ Step 9 – Read the Quote and Choose a Position to start trading

👉 You may have noticed that the prices for currency pairings are shown in two different rates, namely a “Buy” and “Sell”. For instance, with EUR/USD, the Euro is the base currency and USD is the quote currency. When you view a currency quote, you will notice that there are two rates provided.

👉 The “Sell” price is the price at which you can enter a sell position on EUR/USD, while the second rate is the “Buy” price of the currency pair, which means that it is the price at which you can purchase EUR/USD.

👉 The difference between these two rates, or the Bid/Ask price, will give you the spread and this is the amount that your forex broker will charge you for making the trade.

👉 You establish a “Buy” Position if you feel that the base currency’s value will grow relative to the quotation currency. If you purchase EUR/USD, you are betting that the euro’s value versus the dollar will rise. In other words, you have an optimistic outlook for the euro, and the US dollar is bearish.

👉 You initiate a “Sell” position if you feel that the base currency’s value will decline in comparison to the quote currency’s value over the long term.

👉 If you sell EUR/USD, you are betting that the euro’s value will drop versus the dollar at a future time. Thus, you think the euro is in a negative trend, and the US dollar is bullish.

✅ Step 10 – Always control your emotions and stay on top of the numbers

👉 For the uninitiated, forex trading may be a roller coaster of emotions and a minefield of unanswered questions, such as Is it possible that you might have made more money by holding on to your stock longer? How did you not hear about the GDP figures that caused your portfolio to lose value?

👉 Such unresolved questions might take you down a road of uncertainty. That is why it is so critical to maintain emotional stability in the face of both gains and losses while trading.

👉 When it is time to close a position, you must be strict about it and not keep it open hoping the market will turn in your favour.

👉 Make it a habit to review your positions every night after you have closed your trading session. Trades are recorded daily in most trading software. Make sure you do not have any open positions that need to be filled and that you have enough money in your account for future transactions.

5 Best Currency Pairs for Beginner Ugandans to Trade

👉 The dilemma of which currency pair is safe to trade to avoid losing half of your initial deposit on your first position is one that all novice forex traders will face at some point. The answer is as straightforward as it gets, the most stable currency combinations are also the safest.

👉 By referring to a “stable currency pair,” means a pair whose value is not prone to large swings in a brief period. Based on these criteria, the majors are the most liquid and least volatile pairings.

👉 High trading volume, particularly from institutional trading, substantiates the liquidity of these pairings. If a currency pair is highly liquid, you can be certain that you will not be stuck with an asset you cannot sell when you need to because no one is willing to pay the price you are asking.

👉 The best and most stable currency pairs for Ugandan beginners are:

➡️ EUR/USD

➡️ GBP/USD

➡️ USD/CNY

➡️ GBP/JPY

➡️ EUR/CHF

EUR/USD

👉 Most currency exchanges involve the Euro and the US Dollar. Since it contains the currencies of two major economies, this pair may claim a prominent level of liquidity.

👉 There is a positive relationship between EUR/USD and the GBP/USD and a negative relationship between the USD/CHF. Trading this pair is best done during the overlap of the European and American trading hours.

GBP/USD

👉 The British Pound US Dollar currency pair is also quite active. It is favourably correlated with the EUR/USD and negatively correlated with the USD/CHF.

👉 When trading the “cable” (GBP/USD), it is important to consider any noteworthy news that might have an impact on either the US dollar or the British pound. Certain commodities, such as basic metals and Brent crude oil, tend to move in tandem with the British pound.

USD/CNY

👉 The US dollar/Chinese yuan pair is an unusual one and the Chinese Yuan is a stable currency because of the country’s robust economy. In addition, because of the pair’s moderate volatility, Ugandan beginners could benefit from daily price variations without being exposed to excessive risk.

GBP/JPY

👉 In contrast to other pairings, GBP/JPY does not include the US dollar. Events in Japan and the UK have a significant impact on it.

👉 Strong movements in the pair provide opportunities for traders to earn hundreds of pips on a single trade. Trading this instrument could be particularly profitable during the brief overlap between the Asian and European sessions.

EUR/CHF

👉 Even though EUR/CHF (Euro/Swiss Franc) is not a prominent currency pair, it is popular among traders. This is especially true given the inverse connection it has with EUR/USD.

👉 Trading activity in EUR/CHF peaks during the European trading session. Currency traders in this pair pay attention to news from the European Central Bank (ECB), as well as employment and trade figures from Europe.

👉 Ugandan traders should keep an eye on Swiss economic indicators such as GDP, inflation, and employment rates to gauge potential changes in the Swiss franc.

4 Best Currency Pairs for Professional Ugandans to Trade

👉 Expert forex traders need innovative technology and a trustworthy broker. Expert traders might expect higher returns and even make trading their main source of income. The trading mindset and techniques used by pros are often more sophisticated than those used by amateurs.

👉 Regardless of one’s degree of skill, however, the procedure for selecting currency pairings to trade may be universally applied. With improved fundamental and technical research, expert currency traders can more accurately pinpoint winning currency pairings.

👉 There are several good currency pairings available to skilled Ugandan traders, but some of the greatest ones include:

➡️ EUR/GBP

➡️ EUR/USD

➡️ NZD/USD

➡️ GBP/JPY

EUR/GBP

👉 Since there is no United States dollar involved, this is a minor currency pair that is often overlooked. This is an unpredictable duo because of the geographical proximity and strong commercial ties between Europe and the United Kingdom.

👉 The exchange rate between the Euro and the British Pound has been very unstable in the time leading up to Britain’s exit from the European Union. The interest rates that the European Central Bank and the Bank of England decide to use are another important aspect to keep an eye on.

EUR/USD

👉 The most often traded currency pair is the Euro and the US dollar, which stands for the two largest economies in the world.

👉 The exchange rate between these two main currencies is very liquid and tied to statements from the European Central Bank, the United States Federal Reserve, and the Non-Farm Payrolls (NFP) data.

NZD/USD

👉 NZD/USD, sometimes known as “Kiwi,” is a well-known minor currency pair. Ugandan traders must note that there is a positive link between the NZD/USD and the AUD/USD pair.

👉 When trading this pair, the most significant variables to keep an eye on are the shifts in interest rates made by the Reserve Bank of New Zealand and the Federal Reserve.

GBP/JPY

👉 The United States dollar is not included in the GBP/JPY currency pair, in contrast to the other currency pairings stated above. The current situation in Japan and the United Kingdom has a significant impact on it.

👉 The pair can develop powerful trends, which provide opportunities for traders to make several pip gains from a single position. Trading in this asset may be especially profitable during the few periods when the Asian and European trading sessions overlap with one another.

8 Best No-Deposit Forex Brokers in Uganda

👉 When you open an account with a forex broker, they may give you a bonus without requiring a deposit upfront. This allows you to begin trading in the forex market without having to risk any of your own money.

👉 They are mostly reserved for novice investors and come with a string of terms and restrictions around how you may trade it and when you can withdraw your gains. In most cases, they are designated for novice traders.

👉 The best No-Deposit Forex Brokers in Uganda are:

➡️ XM – $30 No-Deposit Bonus

➡️ RoboForex – $30 No-Deposit Bonus

➡️ InstaForex – $1,000 No-Deposit Bonus

➡️ SuperForex – $88 No-Deposit Bonus

➡️ MTrading – $30 No-Deposit Bonus

➡️ FBS – Up to $100 Quick Start and $140 Level-Up Bonus

➡️ Trade Nation – 1,000 points when Ugandans register an account

➡️ Tickmill – $30 No-Deposit Welcome Account

XM

Min Deposit

USD 10

Regulators

IFSC, CySec, ASIC

Trading Desk

Meta Trader 4

Crypto

Yes

Total Pairs

55

Islamic Account

No

Trading Fees

Low

Account Activation Time

24 Hours

👉 XM offers new Ugandan traders a $30 incentive to test how well their platform functions in a real-world trading scenario. After you have validated your account and claimed your bonus, it will be promptly credited to your trading account.

👉 There is no upper limit on the amount of money that may be withdrawn from your trading account. However, every time cash is withdrawn, your trading bonus will be invalid.

RoboForex

Min Deposit

USD 10

Regulators

IFSC

Trading Desk

Meta Trader 4

Crypto

Yes

Total Pairs

32

Islamic Account

No

Trading Fees

Low

Account Activation Time

24 Hours

👉 RoboForex Traders who pass the verification process and sign up for a live trading account with RoboForex are eligible to get a $30 welcome bonus that does not require an initial deposit.

InstaForex

Min Deposit

USD 1

Regulators

CySEC, FSC

Trading Desk

Metatrader 4

Crypto

Yes

Total Pairs

4

Islamic Account

No

Trading Fees

Low

Account Activation Time

24 Hours

👉 The No-Deposit Bonus provided by InstaForex is an excellent means of getting started in the foreign exchange market. This is your passport to the world’s largest and most liquid market, which is where a considerable number of traders now earn most of their livelihood.

👉 Because of the $1,000 reward, you will not have to risk any of your own money to judge our unrivalled order execution quality in real-world trading conditions. The bonus is immediately applied when the request has been made and may be put to immediate use in trading.

SuperForex

Min Deposit

USD 1

Regulators

IFSC

Trading Desk

Metatrader 4

Crypto

Yes

Total Pairs

300

Islamic Account

No

Trading Fees

Low

Account Activation Time

24 Hours

👉 Every client who establishes a live trading account with SuperForex and then has their account fully verified is eligible to get a $88 no-deposit bonus from the company.

👉 After confirming their accounts, traders just need to click the banner that says “Get the No Deposit Offer” to be eligible for the bonus, which does not need them to make an initial deposit.

MTrading

Min Deposit

USD 100

Regulators

Not Regulated

Trading Desk

Meta Trader 4

Crypto

Yes

Total Pairs

–

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overall Rating

4.1/5

Rated #473 of

Recommended FX Brokers

USD 100

Not Regulated

📱 Trading Desk

MetaTrader 4

₿ Crypto

Yes

📈 Total Pairs

–

Yes

Low

🕒 Account Activation Time

24 Hours

🏛️ Visit Broker

👉 MTrading welcomes new traders from Uganda with a cash incentive of $30 that does not need the trader to make an initial deposit. However, to be eligible for this incentive that does not need a deposit, Ugandans need to complete the whole verification procedure first.

FBS

Min Deposit

USD 1 / 3,500 Ugandan shilling

Regulators

IFSC, FSCA (South africa), ASIC, CySEC

Trading Desk

MetaTrader 4, MetaTrader 5, FBS Trader – all in one mobile trading platform.

Crypto

Yes

Total Pairs

–

Islamic Account

No

Trading Fees

Low

Welcome Bonus

$140 (16 373 KESFind out More)

Account Activation Time

24 Hours

👉 The Quick Start Bonus and the Level Up Bonus are the two distinct types of no-deposit incentives that are offered by FBS. When Ugandans use the FBS mobile app to register for an account, they are eligible to get the $100 Quick Start incentive.

👉 They will be led through a seven-step program in which they will be instructed on how to trade without taking any unnecessary risks.

👉 Ugandan traders can sign up for the Level Up incentive, which entitles them to a free credit of $140 in the Personal Area after their account has been validated.

👉 When investors trade for twenty days in a row, they are eligible to get an extra seventy dollars, which enables them to take whatever earnings they have accumulated.

Trade Nation

Min Deposit

USD 0 / 0 Ugandan Shilling

Regulators

FSCA

Trading Desk

–

Crypto

Yes

Total Pairs

33

Islamic Account

No

Trading Fees

Low

Account Activation Time

24 Hours

👉 Trade Nation provides Ugandans with a loyalty program through which they may earn one thousand trading points after registering their trading account and verifying their identity.

👉 In addition to this, Ugandans who make trades using a Trade Nation Account are eligible to accumulate points for each unit of base currency that they transact.

Tickmill

Min Deposit

USD 100 / 360,000 Ugandan Shilling

Regulators

CySEC, FCA, FSA, FSCA, Labuan FSA

Trading Desk

Meta Trader 4

Crypto

Yes

Total Pairs

62

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

👉 If you are a first-time trader and you sign up for an account with Tickmill, you will be eligible for a $30 Welcome Account bonus. You will not be required to make an initial deposit.

👉 This program is exclusively available to new customers and enables customers to cash out any gains they make while using the bonus money.

Forex Trading – Stock Trading – Cryptocurrency Trading Compared

| 🥇 Forex Trading | 🥇 Stock Trading | 🥇 Crypto Trading | |

| ⏰ Market Hours | 24/5 | 9 am – 3 pm (GMT+3) Monday to Friday | 24/7 |

| 📱 Trading Speed | Instant | Slow | Instant |

| 💰 How is it traded? | OTC | Exchanges | OTC/Exchanges |

| 💵 Price Fluctuation | Fast | Slow | Fast |

| 💸 Min. Trade Size | 0.01 lots | 1 share or fractions | 1 lot or fractions |

| 📈 Volatility | High | Low | High |

| 💧 Liquidity | Very High | Blue Chip Stocks are the most liquid | Only major crypto e.g. BTC, ETH, LTC, DOGE, etc. |

| 📊 Trading Volume | High | High | Medium |

| ⚖️ Regulation | $6.6 Trillion | 7,369,200 | $500 Billion+ |

| 📉 Investment Horizon | Short, Medium, Long-Term | Medium and Long-Term | Short, Medium, Long-Term |

| 📊 Average Leverage Ratios | 1:100 – 1:3000+ | <1:100 | <1:10 |

| ✔️ Susceptibility to Macroeconomic Factors | Yes Rarely as turbulent as Crypto | Yes Economic Performance | Yes Consumer Behaviour Supply and Demand |

How to Choose a Forex Broker in Uganda

Forex Broker Type

👉 Trading in foreign exchange with the help of brokers and dealers brings the global financial markets closer to Ugandan traders. This is attributable to the fact that brokers act as intermediaries between retail traders and institutional market makers.

👉 Non-Dealing Desks are those that do not employ humans to handle customer orders directly but instead use automated technologies.

👉 Spreads supplied to traders can either be fixed or variable/floating, and brokers’ compensation is frequently a predetermined percentage of the spread (for instance, $5 per trading lot).

👉 Market makers, or Dealing Desk brokers, are another type of broker that handle customer orders at a “Dealing Desk.” These brokers make or create a market for their clients, and they take the opposite side of the trade.

👉 In addition, there are also ECN brokers, an execution approach that is also quite common; it connects retail traders with many offers quoted straight from the market makers, resulting in tight spreads.

Regulation and Authorization

👉 One of the first and most crucial things to consider is whether the broker complies with applicable regulations.

👉 As a necessary qualification, a Forex broker’s license is issued by an authoritative agency. Even though there is no way to ensure that you will not run into any troubles while trading, using a registered broker is a good safeguard against fraud.

👉 Market participants may trust that regulators are looking out for their best interests. They shield consumers from shady businesses and keep the playing field level for everyone.

👉 However, foreign currency restrictions might range depending on where you live. Currency exchange markets are governed by national financial authorities in each country.

Commissions and Spreads

👉 Next up on the agenda are things like commissions and spreads. Every broker out there makes money from your transactions in one of two ways: either via commissions or spreads in the bid and ask prices.

👉 There are however businesses that do not rely on set commissions but instead rely on larger spreads to make up for it.

👉 The typical rule is that the wider the spread, the more challenging it is to make a profit. The volume of trading in a particular Forex pair is also an important consideration.

👉 Prominent forex pairs like the Euro to the US Dollar or the Pound to the US Dollar will have far smaller spreads than exotic pairs like the Mexican Peso to the Turkish Lira.

Order Execution Policies

👉 Even more so for day traders who use market orders, the speed at which orders are executed is crucial. It is crucial that your broker executes your orders quickly and at the best cost.

👉 Slower order execution means prices may shift by a few pip(s) before the broker executes the order, reducing your chances of making a profit. Faster than a tick of a watch, the finest Forex brokers can process orders in as little as 0.001 seconds on average.

Financial Instruments and Markets offered

👉 Portfolio diversification is an issue that will become important to you at some point. Therefore, it is crucial to choose a broker that provides access to a wide range of currency pairings, including both major and exotic currencies.

👉 The top Forex brokers often offer 50 currency pairings, along with shares, indices, bonds, futures, options, cryptocurrencies, and commodities. If you are a seasoned trader, you know that diversification is key to your success.

Customer Support

👉 Customer care from your broker should be available around the clock since Forex trading occurs constantly.

👉 You may see whether their customer service is accessible by contacting them via every method. In the case of live chat service, speed of response is of the utmost importance.

👉 Sometimes technical issues arise, and when they do, you do not have hours to wait for assistance. Customer service is another key factor to think about before signing up with a Forex broker.

Accounts and Features

👉 When opening an account with a broker to trade Forex for the first time, you will need to pick what kind of account best suits your needs. Micro accounts, small accounts, normal accounts, VIP accounts, etc. are all examples of the many account kinds available.

👉 All of them demand a certain starting sum and a certain quantity of lots to get started. Micro and small account holders, for instance, may trade with lots of 10,000 or even 1,000 units rather than the conventional lot’s 100,000.

👉 In addition, the leverage varies from account to account, and may go as high as 1:3000 and can start from 1:1. Investigate the different account options provided by a broker to determine if any of them meet your needs.

Order Types

👉 Market orders, limit orders, and stop orders are just some of the many order types made available by the best Forex brokers. When dealing in foreign exchange, the market order is the most fundamental and common sort of order.

👉 By placing this order, you will join the market at the best available price at the time. Keep in mind that the price at which your order is completed may differ from the price at which it was placed.

👉 Once a currency pair hits the stop order’s specified sell or buy price, the order automatically converts to a market order. It may be used in two ways, either to start a new transaction or to end one.

👉 Stop orders can be divided into two categories:

➡️ The first is a buy-stop order, which allows you to join a market after the price hits or surpasses your set price.

➡️ The second kind of order is a “sell-stop order,” in which you sell a currency pair if and only if it hits or falls below a certain price.

👉 In addition, when you want to enter the market or exit an existing position at a certain price or above, you use a limit order.

Education Materials

👉 To show they value their clients, brokers that provide a variety of educational resources are necessary. For those just starting in the Forex market, the aid of educational resources may shorten the learning curve.

👉 Learning the lingo used in trading is crucial for newcomers, thus a brokerage that provides instructional resources is preferable. Some Forex brokers provide clients with access to educational resources.

👉 Some organizations provide free, in-depth online training in the form of webinars or instructional videos. Keep in mind that well-educated traders may make more money with less effort.

Trading Styles Supported

👉 The greatest brokers in the industry do not limit their clients’ trading strategies in any way. Consider your trading style while making a brokerage selection. Before deciding on a forex broker, think about how often and how long you plan to trade (long-term versus short-term).

👉 For example, if you are a scalper, it is important to choose a brokerage that supports your trading style and employs an ECN platform. If day trading is your preferred strategy, then you should place a premium on swift execution, tighter spreads, and consistency.

Trading Platform

👉 Foreign exchange (Forex) transactions are typically conducted via the use of the brokerages’ own trading platforms. The most popular trading platforms in the market are MetaTrader 4 and MetaTrader 5, and all reputable brokers in the industry provide at least one of them.

👉 However, there are some exceptions in the case of eToro, Plus500, and other reputable brokers who only offer proprietary trading software.

👉 Consider the platform’s capabilities while deciding on a Forex broker. You should search for features such as:

➡️ Charting and technical analysis tools

➡️ Automated trading

➡️ Real-time quotations

➡️ Customization choices

➡️ Several timeframes

➡️ Charting capabilities

➡️ Various order execution methods

➡️ Strategy backtesting

➡️ Support for several languages

Leverage and Margin Call Policies

👉 You should research a broker’s margin call requirements before placing any orders with them. When our trading account’s margin falls below the required level, our Forex broker may issue a margin call.

👉 It is up to the discretion of the broker as to whether to conclude the investor’s transactions or raise the margin in these circumstances. You should also consider leverage and choose a level that is appropriate for your trading experience and style.

Deposit and Withdrawal Options

👉 The ability to deposit and withdraw funds from your account is crucial. You should inquire as to the financing options the broker provides, especially whether they offer local payment options in Uganda.

👉 For instance, several brokers allow for payments to be made by PayPal, Skrill (Moneybookers), and credit and debit cards. Checking into the various financing options and the associated expenses are a clever idea. In addition, make sure you know the broker’s withdrawal and deposit policies.

Before You Start Trading, Read these Few Basics to Forex Trading

➡️ The market where currency exchange takes place is known as the foreign exchange market.

➡️ One of the reasons why currencies are crucial is that they allow for the purchase of goods and services not only in the immediate vicinity but also outside national borders.

➡️ Currency conversion is the first step that must take place to engage in international trade and business.

➡️ This international market is distinguishable from others that are comparable in that there is no one marketplace where purchasing and selling of foreign currency are possible.

➡️ Nowadays, the trading of currencies does not take place on a single centralized exchange; rather, it is conducted electronically over the counter, which is abbreviated as OTC most of the time.

➡️ Using computer networks, all trades are conducted between buyers and sellers located in various parts of the world.

➡️ Currency trading takes place all over the world in the major financial centres of Frankfurt, Hong Kong, London, New York, Paris, Singapore, Sydney, Tokyo, and Zurich. These cities include New York, Paris, Singapore, and Zurich.

➡️ The foreign exchange market is open five and a half days a week, all twenty-four hours of each day.

➡️ You are required to open an account with either your bank or a licensed broker to engage in transactions using foreign currency.

➡️ An investor may earn a profit from the difference in interest rates supplied by two dissimilar economies by acquiring the currency that offers the higher rate of interest and selling short the currency that offers the lower rate of interest. This strategy is known as “buying high and selling low.”

➡️ When most people talk about the currency exchange market, they are often referring to the spot market.

➡️ Because forwards and futures markets provide more flexibility, these markets are often of greater interest to businesses that need to hedge their foreign currency risks out to a specific date in the future.

➡️ Trading in the most crucial underlying real asset for the forwards and futures markets, the spot market has historically been the most lucrative form of foreign currency trading. This is because the spot market is where forwards and futures markets are based. This is because it engages in transactions involving the money itself.

➡️ A forward contract is a type of contract in which two parties agree to purchase a certain currency at a future date and at a predetermined price in the over-the-counter markets.

➡️ A futures contract is a more typical type of contract in which two parties agree to accept the delivery of a certain currency at a future date and a predetermined price. Instead of being traded over the counter, futures are done so on exchanges.

➡️ The risk of currency fluctuation is posed to firms when they operate in international markets by purchasing and selling goods and services in locations other than their home country. By establishing a mutually agreed-upon price for the transaction that is to be carried out, forex markets make it possible to hedge against the risk of currency fluctuations.

➡️ The daily volatility seen in the currency markets may be attributed to several variables, including but not limited to interest rates, trade flows, tourist demand, economic power, and geopolitical risk.

20 Forex Terms you Must Know

👉 Forex trading jargon refers to phrases that are often used in the context of forex trading and are frequently exchanged amongst forex traders.

👉 If you are not familiar with the terminology used in forex trading, it will be impossible for you to become an expert in forex trading. Some of the most common terms and definitions that Ugandans must know are:

➡️ Exchange Rate

➡️ Cross Rate

➡️ Pip

➡️ Leverage

➡️ Margin

➡️ Spread

➡️ Bid and Ask Price

➡️ Copy Trading

➡️ CFD

➡️ Demo Account

➡️ Technical Analysis

➡️ Fundamental Analysis

➡️ Technical Indicator

➡️ Trend

➡️ Bull and Bear Market

➡️ Stop-Loss and Take Profit

➡️ Trading Strategy

➡️ Liquidity

➡️ Volatility

➡️ Inflation

Exchange Rate

👉 A value represented in one currency is stated in terms of another currency. For instance, if the value of UGX/USD is 0.00027, then 1 Ugandan Shilling is equivalent to $0.00027 in US currency.

Cross Rate

👉 The exchange rate that applies between two currencies, neither of which is the official currency of the nation whose currency is being quoted for use in the context of currency exchanges.

👉 This term is also often used to refer to currency quotations that do not include the United States dollar, regardless of which country the quote is offered in. This use applies to both domestic and international currency quotes.

Pip

👉 “Percentage in point” is what “pip” stands for. A pip is a digit that comes after the decimal point in most currencies; it is the fourth digit. Take the number 1.8956 as an example; the last six represent the pip. In the world of foreign exchange, the smallest possible unit of currency is known as a pip.

Leverage

👉 The term “leverage” refers to the capacity to increase one’s net worth by using one’s account to purchase assets at a price higher than the account’s margin allows.

👉 If a Ugandan trader has $1,000 in margin and initiates a $100,000 position, the trader has 100 times as much leverage, or 1:100. If he deposits $1,000 as margin and then launches a $200,000 stake, his leverage is 1:200.

👉 In addition, Ugandans must remember that both gains and losses are inflated when leverage is increased.

Margin

👉 This refers to the initial or ongoing position deposit and both “free” and “used” forms of margin exist in forex trading. Utilized margin is the amount needed to keep a trade open, whereas free margin is the amount that may be used to initiate new positions.

👉 You may purchase or sell a position up to a notional $100,000 with only a $1,000 margin balance and a 1% margin requirement. A trader may double his starting capital by 100 (the leverage ratio) in this way.

👉 If a trader’s account balance drops below the “margin call” threshold, they will be asked to either replenish the account or liquidate the current position.

👉 When the margin balance drops below the minimum amount needed to keep a transaction active, most brokers will terminate the contract automatically. Depending on the broker, you may need to keep as much as 50% of the margin you used to make the transaction just to keep it open.

Spread

👉 The disparity between the asking price and the selling price. If the exchange rate between the euro and the dollar is quoted as 1.3200/03, the spread is 3 pips, or 0.013.

👉 A transaction or position must subsequently move in the direction of the trade by an amount that is exactly equal to the spread to break even on the transaction.

Bid and Ask Price

👉 The rate at which the forex market (or your forex broker) is willing to purchase a certain currency pair from you is referred to as the bid. Therefore, a Ugandan trader could sell the base currency to their online forex broker if they do so at the bid price.

👉 The price at which the forex market (or your online broker) is willing to sell a certain currency pair to you is referred to as the “ask price.” Therefore, you can purchase the base currency from your broker if you pay the requested price.

Copy Trading

👉 Copy-trading allows you to see the transactions carried out by other traders and gives you the option to duplicate such transactions.

CFD

👉 Contract for Difference is what “CFD” stands for. Today, the most frequent method that which individuals trade foreign exchange is via the use of CFDs.

👉 Trading contracts for difference (CFDs) is like entering into a contract to purchase an item at a certain price. However, the difference between CFD trading and other methods of purchasing assets is that you do not legally possess the asset at any given point.

Demo Account

👉 A sort of trading account that is provided to traders so that they may evaluate the performance of a broker, test strategies, and test the broker’s market condition. The most prominent feature of a demo account is that you are not dealing with actual currency.

Technical Analysis

👉 Traders use a process called technical analysis to make predictions of the market by analysing charts of its past performance.

Fundamental Analysis

👉 A trader uses fundamental analysis to speculate on what will happen to the market by basing their assumptions on current events and news.

Technical Indicator

👉 An instrument that monitors a certain aspect of the market and provides information to traders about whether they should make a deal is known as an indicator.

👉 There is a wide variety of information that may be measured using indicators, including volatility, trading volume, liquidity, market sentiment, and so on.

Trend

👉 A forex pair’s overall movement may be characterized by its trend, which is an overarching direction. Forex trends are dynamic and can go in one of three directions: up, down, or sideways.

👉 If you want to be a successful trader, you need to understand that you should trade in the same direction as the trend, not against it.

Bull and Bear Market

👉 When prices are moving in an upward direction, this kind of market is known as a bull market or bullish market. When prices are moving in a downward direction, this kind of market is known as a bear market or bearish market.

Stop-Loss and Take Profit

👉 You may get out of a position on a trading platform using a mechanism known as a stop-loss if the price drops below a certain threshold. This may prevent you from incurring large losses.

👉 There are several variations of stop-losses to choose from. One that is particularly worthy of notice is the “trailing stop-loss.” To put it simply, a take-profit order is the antithesis of a stop-loss order. This means that your transaction is terminated after it achieves a certain amount of profit.

Trading Strategy

👉 When you trade forex, you should have a plan that you follow, and this is known as a trading strategy. Forex trading strategies might vary widely from one person to the next based on their unique trading style, objectives, time horizons, and other factors.

Liquidity

👉 In the world of foreign exchange, the term “liquidity” relates to how simple it is to acquire or sell a certain currency pair. When a currency pair has a prominent level of liquidity, it is simple to enter and exit a transaction in that pair.

Volatility

👉 The degree to which the value of a forex pair is fluctuating over time is referred to as its volatility. If a currency pair is very volatile, it typically indicates that it is moving between extreme highs and lows in a very quick manner.

Inflation

👉 The overall rise in the cost of goods over a period is referred to as inflation. When the value of many goods goes up, the purchasing power of a currency goes down because of this.

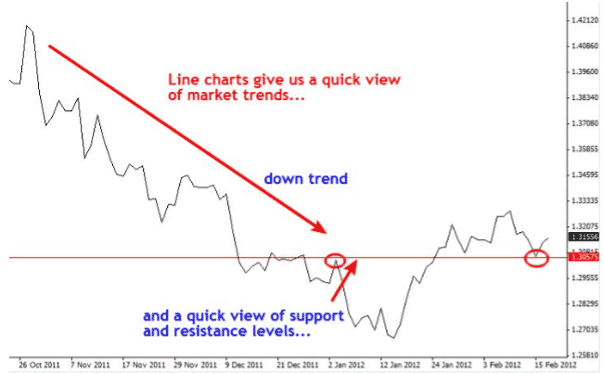

Understanding Forex Charting

👉 Currency pairs’ past price and volume information may be seen in detail on a forex chart. Thus, a forex chart is a graphical representation of a currency’s price movement across many periods, complete with technical patterns, indicators, and overlays.

👉 The most prominent chart types are:

➡️ Line Charts

➡️ Bar Charts

➡️ Candlestick Charts

Line Charts

👉 For a fast snapshot of the market’s general trend and the current support and resistance levels, look no further than a line chart.

👉 However, you cannot make good trading decisions based only according to line charts since they do not show individual price bars, but you can get a good sense of the market’s overall direction by looking at them periodically.

👉 To create a line chart, a line is drawn from the high of one period to the high of the next, from the low of one period to the low of the next, or from the open of one period to the close of the next.

👉 The closing price of a market is considered the most essential since it indicates who won the struggle between the bulls and the bears for that time, hence line charts that demonstrate a relationship from one closing price to the next are the most valuable and used kind of chart.

Bar Charts

👉 Each “bar” in a bar chart represents a certain price over a certain time range. In other words, a daily chart will have one price bar for each day, a 4-hour chart will have one price bar for every 4 hours, etc.

👉 Each price bar provides us with four pieces of data that might guide our trading decisions: Here’s an example of a price bar that includes the open, high, low, and close data often seen on bar charts known as OHLC plots.

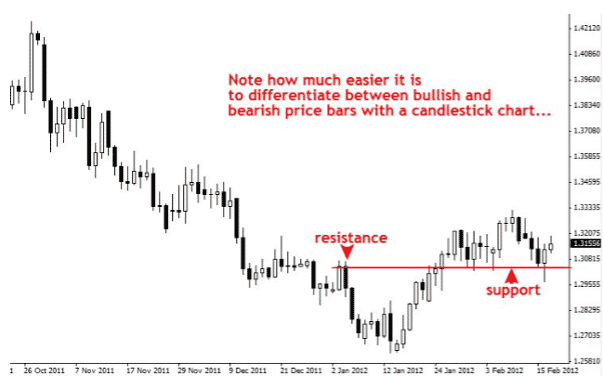

Candlestick Charts

👉 Candlestick charts provide the same data as bar charts but do it in a more visually appealing way. Like how bar charts show highs and lows, candlestick charts use a vertical line to depict the range of prices within a certain time frame.

👉 The vertical line at the top is known as the upper shadow, the vertical line at the bottom as the lower shadow, and both as wicks. The most noticeable distinction is in the representation of the starting and closing prices in candlestick charts.

👉 The spread between the day’s opening and closing prices is shown by the big body of the candlestick. The “true body” is the term often used to describe this section.

👉 When the actual body is filled in (shown by a darker colour), the currency ends the day at a lower value than when it opened, and when it is left empty (represented by a lighter colour), the money ends the day at a greater value.

👉 In the case of a white or similarly light real body, for instance, the top of the real body would represent the close price, while the bottom would represent the open price. Black or dark-coloured real bodies often have the open price at the top and the closing price at the bottom.

Effective Risk Management for Ugandan Forex Traders

👉 Before worrying about how much money you can earn in the market, you should focus on keeping what you have safe. Risk management is a concept with deep roots in economics and a wide range of practical applications.

👉 One of the first things you need to know when getting started in forex trading is that you will inevitably incur a monetary loss. Once you have mastered trading, though, you can reduce your exposure to risk and boost your profits.

👉 Although there are numerous facets to risk management in forex trading, it is one of the most significant learning arcs for novice forex traders. However, the riskiest action you might do is to go off without a map. Betting is the opposite of risk management, so avoid it if you can.

👉 When it comes time to get out of a deal, it helps to have a strategy. As part of prudent risk management in foreign exchange trading, traders should abandon plans and methods that are no longer profitable.

👉 Finally, it all comes down to taking as few chances as possible. Avoiding risk may be as easy as avoiding joining up with an unregulated broker just because they are offering a bonus. Here are some of the best risk management tips for Ugandan traders:

➡️ Always remain in control – A trader who has self-control uses a trading method that is tailored to their preferences. Using the principles of risk management, they invest only disposable income. Such a trader is open to the latest information and is emotionally secure; these traits bode well for their ability to persevere in the market and eventually achieve professional status.

➡️ Position Sizing – The triangle is the key to reducing financial losses namely Position Size, Leverage, and stop-loss orders. Position size is a method for determining the number of units to trade to reach a certain level of risk. You should never risk more than 3% on a single trade.

➡️ Use Leverage and Margin wisely – The margin requirements of Forex traders are determined by their brokers. Margin is typically 2%-4% of the amount of the trade. One percent margin is often called 1:100 leverage since it represents a leverage ratio of 100 times the amount of margin required. Though the benefits of leverage are clear, traders must exercise caution. Leverage magnifies outcomes in both directions. Therefore, Stop Loss orders should be used in conjunction with leveraged trading to mitigate risk.

➡️ Risk-Reward – The risk-to-reward ratio is another variable in your hands. If you want to enhance your chances of making a profit, you should aim for a situation in which the potential gain outweighs the potential loss. The larger the potential benefits, the more losing transactions your trading account may sustain. If your risk/reward ratio is 1:3, for example, you only need one winning transaction to break even after three losing trades with the same ratio.

➡️ Diversification – One of the fundamental tenets of sound investing is to spread your investments around. You should not “place all your eggs” in one basket since the basket might break. The answer is to trade many currency pairings, according to the portfolio approach. However, you should be familiar with certain currency pairings.

➡️ A Solid Trading Plan – Each Ugandan trader needs their own unique trading strategy because of the personal nature of the trading profession. Expectations, risk management guidelines, and a trading strategy are all essential components of any such plan (s). You can better organize your ideas, rein in your emotions, and avoid making hasty judgments if you have a strategy laid out.

5 Best Forex Strategies for Ugandan Traders Revealed

👉 A forex trader’s strategy is the method through which they choose which currency pairs to purchase and sell. Technical analysis and fundamental analysis are only two of the many forex tactics available to investors.

👉 With the help of a solid forex trading strategy, Ugandan traders can confidently analyse the market and place trades using safe risk management practices. The following five strategies are some of the best for Ugandan traders in 2023:

➡️ Price Action

➡️ Range Trading

➡️ Trend Trading

➡️ Position Trading

➡️ Day Trading

Price Action

👉 To develop effective technical trading techniques, price action traders analyse past price data. Indicators are not required when using price movement as a trading method. Although fundamentals are seldom cited, economic developments are sometimes offered as support.

Range Trading

👉 It is customary practice in range trading for traders to make transactions around important levels of support and resistance they have identified. This tactic is useful in a market when there is no clear trend and little volatility. This tactic mostly makes use of technical analysis.

Trend Trading

👉 Trading with the trend, rather than against it, is a common and effective Forex approach. To make a profit, trend trading looks to riding the wave of market momentum in one direction.

Position Trading

👉 Position trading is a long-term strategy that looks at fundamental reasons primarily, but also makes use of technical tools like Elliot Wave Theory. This approach disregards inconsequential market changes. This method applies to the Forex as well as the stock market.

Day Trading

👉 Trading financial instruments many times during a single trading day is known as “day trading.” So, all trades are closed before the market closes. There is no restriction on the number of transactions each day.

Spot, Forwards, and Futures in Forex Trading

👉 There are three distinct Forex marketplaces where traders can participate in forex trading, namely:

➡️ Spot Market

➡️ Forwards Market

➡️ Futures Market

Spot Market

👉 Spot Market is the most widely used of the three, and it facilitates the trading of “actual assets” among investors throughout the globe using electronic communications networks, broker dealing desks, contracts for difference, and direct interbank exchanges.

👉 In addition, the spot market prices are determined by the forces of supply and demand.

Forwards Market

👉 The Forwards Market is a more advanced trading platform used by multinational corporations and institutional investors to manage their exposure to foreign exchange fluctuations.

👉 To hedge against foreign currency rate swings and price shocks, traders may use futures contracts. In a forward contract, the parties set the price, which may be quite different from the interbank or futures prices.

Futures Market

👉 Before the rise of retail forex brokers, the futures market was the primary exchange for foreign currency transactions. The National Futures Association establishes contract sizes and settlement dates for futures traded on the Chicago Mercantile Exchange (CME) in the United States.

👉 Currency futures contracts may also be traded on the smaller markets of other nations. The exchange is always the counterparty to a contract, and it is the exchange that sets the minimum price increments, the dates of delivery and settlement.

An introduction to Forex Brokers

👉 A broker is an independent individual or business that coordinates and performs financial transactions on behalf of another party.

What is the Role of a Forex Broker?

👉 A forex broker is also typically referred to as an FX broker, online broker, or retail forex broker acts as your representative while buying and selling currency on the forex market.

👉 One of the advantages of working with a foreign exchange broker is having access to the market around the clock and being able to speculate on currency pairings from all over the globe.

👉 When it comes to being competitive in the market, forex brokers strive to keep their expenses as low as possible; yet, when you trade with them, you are still responsible for some fees, including a spread.

👉 Since transactions in the foreign exchange market are always conducted in pairs, to trade, you will either need to buy or sell the pair that you are interested in trading, such as GBP/USD.

How do Forex Brokers Make Money?

👉 When you place a deal, Forex brokers earn money by collecting a commission. Pips are used to indicate a 1% change in the value of a currency pair.

👉 The forex broker will take a little commission from your deal total before executing it on the market. The market may be purchasing EUR/USD at 1.3100, but your broker may execute your deal at 1.3102.

👉 Your forex broker will pocket the difference between the “market price” and the amount you paid if you cancel your deal right away. The term “spread” describes this phenomenon.

👉 You may be wondering why a forex broker would choose something so inconsequential to generate a profit. The simple explanation is that most traders do not give much consideration to a spread of a few pips.

👉 Subsequently, the charge is more understandable. A forex broker generates money by providing you with leverage while trading foreign currency.

👉 When using leverage, you may exert influence on the market equivalent to a sum greater than the cash you have on hand. The leverage of 1:100 means that if you deposit $10, you can trade $1,000 worth of currency.

👉 As a result, not only does the spread you pay have a greater potential for gain (or loss), but so does each pip individually. In forex trading, the broker makes money from the spread between the price you pay and the “market price” they pay regardless of whether you win or lose.

👉 A forex brokerage’s primary function is to facilitate your entry into the forex trading market so that you may participate in it profitably. Quite a few of them can also teach you the ropes of the trading world.

The Importance of Market Sentiment in Forex Trading

👉 Market sentiment is the present “mood” of the market. The market’s mood may be compared to people’s emotional states. There are a variety of factors that might cause rapid shifts in it, including one’s own thoughts, emotions, and behaviours.

👉 The demand and supply of any given currency, asset, or commodity are determined by the prevailing mood. If investors have faith in the future of a market, bulls will start to purchase more, driving up demand and, in turn, prices.

👉 The market may be now positive and as an alternative, if the market sentiment is negative, a price decline is anticipated.

👉 The mood of one market is indicative of the mood of all markets. It is just a matter of time until extreme optimistic or negative emotion completely dominates the market.

👉 For instance, if you have opened a short position on AUD/USD, the announcement of the good news boosted market confidence. When investors are optimistic and willing to take on more risk, the value of risky assets increases.

👉 You went with your advice and ignored the market’s mood. However, because you were not paying attention to market sentiment, the pair’s value went up and you lost money. It may be possible to avoid making such errors by learning to recognize the significance of market emotion.

👉 Determine if traders are net-long or net short to inform your own trading choices in the foreign exchange market using sentiment research.

👉 Currency pairs are not the only assets where sentiment analysis is used; equities are another popular application. If many people are buying or selling a certain currency pair, that is a good sign for contrarian investors who are waiting to make a trade in the other direction.

👉 A sentiment indicator is a numerical or graphical indication of the degree to which investors are bullish or bearish about future market performance.

👉 In the context of currency pairs, this might indicate the share of transactions that have adopted a certain stance. For instance, if 70% of traders are bullish and 30% are bearish on a currency pair, then 70% of traders are bullish.

👉 Two of the best sentiment indicators are:

➡️ IG Client Sentiment – Incorporating IG Client Sentiment into your trading approach might be helpful. The ratio of long to short transactions in each market may be an insightful indicator of when sentiment is shifting.

➡️ The commitment of Traders Report – The Commodity Futures Trading Commission (CFTC) publishes a weekly report called the Commitment of Traders (COC) Report, which is collected from submissions from traders in the commodity markets and paints a picture of the commitment of categorized trading groups. Released weekly at 3h30 pm Eastern Time, the CFTC report may serve as a market indicator.

MetaTrader 4 VS MetaTrader 5

| 4️⃣ MetaTrader 4 | 5️⃣ MetaTrader 5 |

| Most traders in Uganda will like MetaTrader 4’s user-friendly interface | The same user interface layout, but with more functionality, features, and advantages |

| Comprises a total of nine different timeframes | Features Twenty-one unique epochs may be distinguished |

| There are currently four orders that have not been sent (buy stop, buy limit, sell limit, sell stop) | There are Still Six Outstanding Orders (buy stop, buy limit, buy stop limit, sell stop, sell limit, sell stop limit) |

| Features With the help of the MQL4 programming language, hedging is a real possibility | Features Hedging and netting are possible thanks to MQL5, a programming language |

| There are 30 pre-built indications, 2,000 user-defined indicators, and 700 premium indicators | Includes infinite charts, 38 different indicators, and 44 different analytical objects |

| The market is too shallow for that | Available market depth |

| The Economic Calendar Does Not Exist | It includes a calendar for economic events |

| WebTrader works with browsers such as Chrome, Firefox, Safari, IE, Opera, and Edge | WebTrader works with browsers such as Chrome, Firefox, Safari, IE, Opera, and Edge |

| Desktop terminal compatible with Windows 7/8 and Mac OS X | Desktop terminal compatible with Windows 7/8 and Mac OS X |

| Both Apple and Google mobile operating systems support the app | The application is fully compatible with both iOS and Android smartphones and other devices |

| There are three distinct modes of execution | There are four distinct modes of operation |

| Exchange trading is prohibited | Ugandans have access to the foreign currency market |

| Each of the 1,024 possible permutations of symbols | Infinite Symbols Are Available |

| Lack of Partial Order Filling Policies | Multiple partial order filling rules exist. |

| The order fill policy is “Fill or Kill | Fill, Kill, or Cancel Return is the Order Fulfilment Policy |

| Limitations apply only to report tables | Offers Instant Graphs and Tables in Reports |

| Time and Sales Exchange Data Log File is not compatible with Zip compression | Time and sales data are both accounted for, and Log files are automatically compressed using zip |

| The 31 Graphical Objects in this set represent a wide range of topics and styles | Over forty-four Graphical objects are available to Ugandans |

| Optionally, a Single-Threaded Strategy Tester may be used | Real tick data is included in the Multi-Threaded Strategy Tester’s simulations of several currency pairs |

| Even though there is a powerful email system, attachments are not allowed | This all-inclusive solution allows you to send emails with attachments |

| Inadequate support for several languages in Unicode | Multilingual Unicode is supported |

| Currently, there is no option to move money across accounts | Funds may be moved around between accounts |

| The MQL5 platform does not have a built-in forum or discussion board | The website also has a built-in chat room for the MQL5 community |

| Suitable For: individuals just getting started with foreign exchange trading or seasoned pros who want a less complex interface | Ideal for: Traders in Uganda who want a lot of flexibility in their trading software |

Best Forex Brokers in Uganda

👉 Overall, OANDA is the best MT4 forex broker in Uganda. OANDA offers MetaTrader 4 alongside an award-winning proprietary trading platform. OANDA offers Ugandan traders local deposit and withdrawal options and a plethora of educational tools and resources.

Best MetaTrader 5 / MT5 Forex Broker in Uganda

Min Deposit

–

Regulators

–

Trading Desk

–

Crypto

Yes

Total Pairs

–

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

👉 Overall, Admirals is the best MetaTrader 5 forex broker in Uganda. In addition to MetaTrader 5 Admirals offers the MetaTrader Supreme edition for professional traders. Admirals offers a choice between 6 retail accounts, commission-free trading options, and zero-pip spreads.

Best Forex Broker for beginners in Uganda

Min Deposit

USD0

Regulators

IGRs

Trading Desk

MetaTrader 4

Crypto

Yes

Total Pairs

80

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

👉 Overall, IG is the best forex broker for beginners in Uganda. IG is the best broker for beginners based on the vast range of educational materials and resources offered. IG also provides a demo account and dedicated customer service to Ugandan traders.

Best Low Minimum Deposit Forex Broker in Uganda

Min Deposit

USD 1 / 3,500 Ugandan shilling

Regulators

IFSC, FSCA (South africa), ASIC, CySEC

Trading Desk

MetaTrader 4, MetaTrader 5, FBS Trader – all in one mobile trading platform.

Crypto

Yes

Total Pairs

–

Islamic Account

No

Trading Fees

Low

Welcome Bonus

$140 (16 373 KESFind out More)

Account Activation Time

24 Hours

👉 Overall, FBS is the best Low Minimum Deposit Forex Broker in Uganda. When signing up with FBS Ugandan traders can expect an ultra-low minimum deposit requirement of just 3,700 UGX. FBS offers a choice between retail accounts and a robust mobile trading platform.

Best ECN Forex Broker in Uganda

Min Deposit

USD 200 / 735,164 UGX

Regulators

ASIC, BaFin, CMA, CySEC, DFSA, FCA, SCB

Trading Desk

MetaTrader 4, MetaTrader 5, cTrader and TradeView

Crypto

Yes (Not available in Africa)

Total Pairs

60+

Islamic Account

No

Trading Fees

Low

Account Activation Time

24 Hours

👉 Overall, Pepperstone is the best ECN forex broker in Uganda. As one of the largest brokers in the industry, Pepperstone offers the best liquidity and trade execution speeds to scalpers and day traders in Uganda.

Best Islamic / Swap-Free Forex Broker in Uganda

Min Deposit

USD 1

Regulators

IFSC

Trading Desk

Metatrader 4

Crypto

Yes

Total Pairs

300

Islamic Account

No

Trading Fees

Low

Account Activation Time

24 Hours

👉 Overall, SuperForex is the best Islamic / Swap-Free forex broker in Uganda. SuperForex offers Muslim Ugandans a choice between dedicated Islamic Accounts. SuperForex provides a plethora of research tools to advanced traders and some of the best trading conditions.

Best Forex Trading App in Uganda

Min Deposit

USD 10

Regulators

CySec, FSCA

Trading Desk

MetaTrader 4 and MetaTrader 5

Crypto

Yes

Total Pairs

–

Islamic Account

No

Trading Fees

Low

Account Activation Time

24 Hours

👉 Overall, FXTM is the best forex trading app in Uganda. FXTM is one of the best African brokers that provides a powerful trading app for Ugandan traders. FXTM provides more than 250 markets and Ugandans can expect local deposit and withdrawal options.

Best Ugandan Shilling Trading Account Forex Broker in Uganda

Min Deposit

USD 10

Regulators

FSCA, FSA, CySEC, FCA, CBCS, FSC (BVI), FSC (Mauritius), CMA

Trading Desk

MetaTrader 4 and MetaTrader 5

Crypto

Yes

Total Pairs

107

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

👉 Overall, Exness is the best Ugandan Shilling trading account forex broker in Uganda. Exness is one of the only international forex brokers that allow Ugandans to register a trading account in local currency. Exness offers zero-pip spreads along with unlimited leverage according to account equity.

Best Lowest Spread Forex Broker in Uganda

Min Deposit

USD 10

Regulators

IFSC, CySec, ASIC

Trading Desk

Meta Trader 4

Crypto

Yes

Total Pairs

55

Islamic Account

No

Trading Fees

Low

Account Activation Time

24 Hours

👉 Overall, XM is the best lowest spread forex broker in Uganda. XM is known for its zero-pip spreads and wide range of trading opportunities. With leverage up to 1:888 Ugandan traders can increase their profit potential while they are protected by negative balance protection.

Best Nasdaq 100 Forex Broker in Uganda

Min Deposit

USD 5 / 18,000 UGX

Regulators

CySEC, FSC, FSCA

Trading Desk

MetaTrader 4 and MetaTrader 5

Crypto

No

Total Pairs

50+

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

👉 Overall, HF Markets is the best Nasdaq 100 forex broker in Uganda. HF Markets offers a range of markets that includes the popular Nasdaq 100. Ugandans can trade this index as a CFD, and use leverage up to 1:200 while trading it.

Best Volatility 75 / VIX 75 Forex Broker in Uganda

Min Deposit

USD 200 / 718,000 UGX

Regulators

ASIC

Trading Desk

Metatrader 4

Crypto

Yes

Total Pairs

65

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

👉 Overall, IC Markets is the best Volatility 75 / VIX 75 forex broker in Uganda. IC Markets is the largest true ECN broker that provides Ugandans access to the CBOE Volatility Index.

👉 With IC Markets Ugandans can trade this instrument as a Futures CFD and gain access to competitive zero-pip spreads.

Best NDD Forex Broker in Uganda

Min Deposit

0 USD

Regulators

FSA, FCA, ASIC, DFSA

Trading Desk

MetaTrader 4

Crypto

Yes

Total Pairs

66

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

👉 Overall, Axi is the best NDD forex broker in Uganda. Axi is a well-known and regulated forex and CFD broker that operates a No-Dealing Desk. Axi does not charge any account fees and traders can expect a plethora of social trading opportunities through advanced platforms.

Best STP Forex Broker in Uganda

Min Deposit

USD 100/350,000 Ugandan Shilling

Regulators

ASIC, FSA

Trading Desk

MetaTrader 4, MetaTrader 5, Ava Social, Ava Protect, Trading Central

Crypto

Yes

Total Pairs

55+

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

👉 Overall, AvaTrade is the best STP forex broker in Uganda. AvaTrade is one of the most popular brokers in Uganda that offers traders 1,250 financial instruments. With AvaTrade traders can expect superior STP trade execution with minimal slippage and no requotes.

Best Sign-up Bonus Broker in Uganda

Min Deposit

USD 1

Regulators

CySEC, FSC

Trading Desk

Metatrader 4

Crypto

Yes

Total Pairs

4

Islamic Account

No

Trading Fees

Low

Account Activation Time

24 Hours

👉 Overall, InstaForex is the best sign-up bonus broker in Uganda. InstaForex is currently the broker that offers the best sign-up bonus up to $1,000. InstaForex caters specifically for beginner Ugandan traders by offering Cent Accounts with low position sizes and various risk management protocols.

FAQ

Can I trade forex in Uganda?

Yes, you can trade forex legally in Uganda. The Capital Markets Authority (CMA) of Uganda oversees foreign exchange transactions but does not regulate forex brokers who operate in the country.

What is the greatest risk of forex trading in Uganda?

The greatest risks of trading forex in Uganda involve using a scam broker and applying too much leverage to positions.

How much does it cost to start trading forex in Uganda?

You can start trading forex in Uganda with a minimum deposit of 3,700 UGX (or an equivalent of $1).

What is the best trading platform in Uganda?

MetaTrader 4 is currently the best trading platform in Uganda, specifically because it is user-friendly and available on both iOS and Android mobile devices.

What is the best time to trade forex in Uganda?

When it comes to the foreign exchange market, the afternoons and evenings of Tuesday through Thursday are optimal in Uganda.