HF Markets Review

Overall, HF Markets (previously HotForex) is considered low-risk, with an overall Trust Score of 85 out of 100. HF Markets is licensed by one Tier-1 Regulator (high trust), four Tier-2 Regulators (average trust), and two Tier-3 Regulators (low trust). HF Markets offers five different retail trading accounts namely a Micro Account, Premium Account, HFCopy Account, Zero Spread Account, and an Auto Account. HF Markets is currently not regulated by the CMA of Uganda

- Louis Schoeman

Jump to:

Regulation and Safety of Funds

Account Types and Features

Account Registration

Trading Platforms

Range of Markets

Fees

Deposits and Withdrawals

Education and Research

Affiliate Program

Final Verdict

Pros and Cons

FAQ

Min Deposit

USD 5 / 18,000 UGX

Regulators

CySEC, FSC, FSCA

Trading Desk

MetaTrader 4 and MetaTrader 5

Crypto

No

Total Pairs

50+

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

HF Markets Review – 25 key points quick overview:

HF Markets Overview

HF Markets At a Glance

HF Markets Regulation and Safety of Funds

- HF Markets Awards and Recognition

- HF Markets Account Types and Features

- How to open an Account with HF Markets

- HotForex VS GlobalGT VS OspreyFX – Broker Comparison

- HF Markets Trading Platforms

- HF Markets Range of Markets

- Broker Comparison for Range of Markets

- HF Markets Trading and Non-Trading Fees

- HF Markets Deposits and Withdrawals

- How to Deposit Funds with HF Markets

- HF Markets Fund Withdrawal Process

- HF Markets Education and Research

- HF Markets Bonuses and Promotions

- How to open an Affiliate Account with HF Markets

- HF Markets Affiliate Program Features

- HF Markets Customer Support

- HF Markets Corporate Social Responsibility

- Verdict on HF Markets

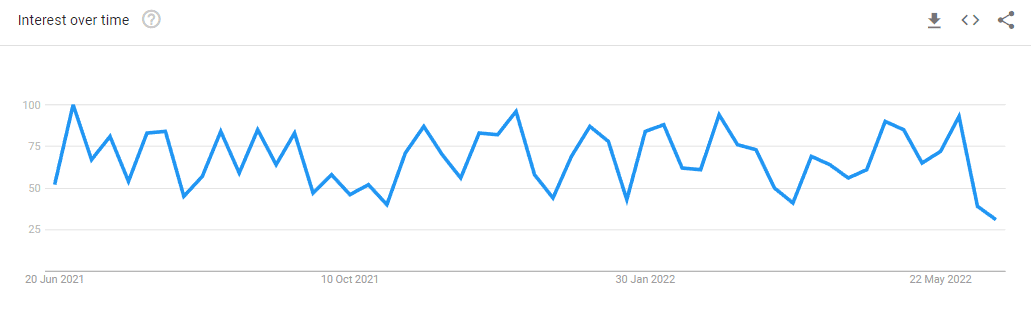

- HF Markets Current Popularity Trends

- HF Markets Pros and Cons

- Frequently Asked Questions

- Conclusion

HF Markets Overview

HF Markets Distribution of Traders

Popularity among traders who choose HF Markets

HF Markets At a Glance

| 🏛 Headquartered | Cyprus |

| 🏙 Local office in Kampala? | No |

| ✅ Accepts Uganda traders? | Yes |

| 🗓 Year Founded | 2010 |

| 📞 Uganda Office Contact Number | None |

| 🤳 Social Media Platforms | • Facebook • Telegram • YouTube |

| ⚖️ Regulation | FSCA, CySEC, DFSA, FSA, FCA, FSC, CMA |

| 🪪 Regulatory Licenses | • South Africa – FSP 46632 • Cyprus – 183/12 • Dubai – F004885 • Seychelles – SD015 • United Kingdom – 801701 • Mauritius – 094286/GBL • Kenya – CMA license 155 |

| Registrations | • France ACPR – 53684 • Germany BaFin – 132342 • Hungary MNB – K8761153 • Italy CONSOB– 3673 • Norway – FT00080085 • Spain CNMV – 3427 • Sweden FI – 31987 • Austria FMA • Bulgaria FSC • Croatia HANFA • Czech Republic CNB • Denmark • Finanstilsynet • Estonia FSA • Finland FSA • Greece HCMC • Iceland FME • Central Bank of • Ireland • Latvia FKTK • Liechtenstein FMA • Lithuania Lietuvos • Bankas • Luxembourg CSSF • Malta MFSA • Poland KNF • Portugal CMVM • Romania ASF • Slovakia NBS • Slovenia ATVP |

| ⚖️ CMA Uganda Regulation | No |

| 🚫 Regional Restrictions | The United States, Canada, Sudan, North Korea, and Syria |

| ☪️ Islamic Account | Yes |

| 💻 Demo Account | Yes |

| 🛍 Retail Investor Accounts | 5 |

| 📊 PAMM Accounts | No |

| 🤝 Liquidity Providers | Barclays UK, BNP Paribas, and others |

| 💸 Affiliate Program | Yes |

| 📲 Order Execution | Market |

| 📊 Average spread | From 0.0 pips |

| 📞 Margin Call | Between 40% to 50% |

| 🛑 Stop-Out | Between 10% and 20% |

| ✅ Crypto trading offered? | 0.01 lots |

| 💰 Offers a UGX Account? | No |

| 👨💻 Dedicated Uganda Account Manager? | No |

| 📊 Maximum Leverage | 1:1000 |

| 🚫 Leverage Restrictions for Uganda? | None |

| 💰 Minimum Deposit | 18,000 UGX or an equivalent to $5 |

| ✅ Uganda Shilling Deposits Allowed? | Yes |

| 📊 Active Uganda Trader Stats | 100,000+ |

| 👥 Active Uganda-based HF Markets customers | Unknown |

| 💳 Uganda Daily Forex Turnover | Unknown, overall Forex Daily Trading Volume is over $6.6 Trillion |

| 💵 Deposit and Withdrawal Options | • Bank Wire Transfer • Credit Card • Debit Card • Electronic Payment Providers |

| 🏦 Segregated Accounts with Uganda Banks? | No |

| 📊 Trading Platforms | • MetaTrader 4 • MetaTrader 5 |

| ✔️ Tradable Assets | • Forex • Precious Metals • Energies • Indices • Shares • Commodities • Cryptocurrencies • Bonds • Stocks DMA • ETFs |

| 💸 Offers USD/UGX currency pair? | No |

| 📈 USD/UGX Average Spread | N/A |

| 📉 Offers Uganda Stocks and CFDs | None |

| 🗣 Languages supported on Website | English, Portuguese, Spanish |

| 📞 Customer Support Languages | Multilingual |

| ⏰ Customer Service Hours | 24/5 |

| 👥 Uganda-based customer support? | No |

| ✅ Bonuses and Promotions for Uganda traders | Yes |

| 📚 Education for Uganda beginner traders | Yes |

| 📱 Proprietary trading software | No |

| 💰 Most Successful Ugandan Trader | Unknown |

| ✅ Is HF Markets a safe broker for Ugandan traders? | Yes |

| 📊 Rating for HF Markets Uganda | 9/10 |

| 🤝 Trust score for HF Markets Uganda | 83% |

| 👉 Open an account | 👉 Open Account |

Min Deposit

USD 5 / 18,000 UGX

Regulators

CySEC, FSC, FSCA

Trading Desk

MetaTrader 4 and MetaTrader 5

Crypto

No

Total Pairs

50+

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

HF Markets Regulation and Safety of Funds

HF Markets Regulation in Uganda

HF Markets Global Regulations

HF Markets Client Fund Security and Safety Features

HF Markets Awards and Recognition

HF Markets Account Types and Features

HF Markets Live Trading Accounts

Micro Account

| Account Feature | Value |

| 💸 Minimum Deposit | 18,000 UGX or an equivalent to $5 or 70 ZAR |

| 📊 Spreads | 1 pip EUR/USD |

| 💻 Trading Platform | MetaTrader 4, MetaTrader 5 |

| 🔧 Trading Instruments | All |

| 📲 Execution | Market Execution |

| 💰 Maximum Leverage Ratio | 1:1000 |

| 📉 Minimum Trade Size | 0.01 lot |

| 📈 Maximum Trade Size | 7 Standard Lots (100,000 base currency) |

| 💸 Maximum Open Orders | 150 (Simultaneous) |

| 📞 Margin Call (%) | 40 |

| 🛑 Stop-Out (%) | 10 |

| 💵 Account Base Currency | USD, ZAR, NGN |

| 👥 Personal Account Manager | Yes |

| 💵 Commission Charges | None |

| ✔️ Bonuses Offered | Flexible bonus offering |

Premium Account

| Account Feature | Value |

| 💸 Minimum Deposit | 360,000 UGX or and equivalent to $100 or R1,400 |

| 📊 Spreads | From 1 pip EUR/USD |

| 💻 Trading Platform | MetaTrader 4, MetaTrader 5 |

| 🔧 Trading Instruments | All |

| 📲 Execution | Market Execution |

| 💰 Maximum Leverage Ratio | 1:500 |

| 📉 Minimum Trade Size | 0.01 lot |

| 📈 Maximum Trade Size | 7 Standard Lots (100,000 base currency) |

| 💸 Maximum Open Orders | 60 Standard lots per position |

| 📞 Margin Call (%) | 50 |

| 🛑 Stop-Out (%) | 20 |

| 💵 Account Base Currency | USD, ZAR, NGN |

| 👥 Personal Account Manager | Yes |

| 💵 Commission Charges | None |

| ✔️ Bonuses Offered | Flexible bonus offering |

HFcopy Account

| Account Feature | Value |

| 💸 Minimum Deposit | Follower: 360,000 UGX or an equivalent to $100 Provider: 1,000,000 UGX or an equivalent to $300 |

| 📊 Spreads | From 1 pip EUR/USD |

| 💻 Trading Platform | MetaTrader 4 |

| 🔧 Trading Instruments | Forex, Spot Indices, Gold, Spot Energies, BTC/USD, BTC/EUR |

| 📲 Execution | Market Execution |

| 💰 Maximum Leverage Ratio | 1:400 |

| 📉 Minimum Trade Size | 0.01 lot |

| 📈 Maximum Trade Size | 60 Standard lots per position |

| 💸 Maximum Open Orders | 300 |

| 📞 Margin Call (%) | 50 |

| 🛑 Stop-Out (%) | 20 |

| 💵 Account Base Currency | USD |

| 👥 Personal Account Manager | Yes |

| 💵 Commission Charges | None |

| ✔️ Bonuses Offered | 200 |

Zero Spread Account

| Account Feature | Value |

| 💸 Minimum Deposit | 720,000 UGX or an equivalent to $200 or R2,800 |

| 📊 Spreads | 0.0 pips on Forex Major currency pairs |

| 💻 Trading Platform | MetaTrader 4, MetaTrader 5 |

| 🔧 Trading Instruments | All |

| 📲 Execution | Market Execution |

| 💰 Maximum Leverage Ratio | 1:500 |

| 📉 Minimum Trade Size | 0.01 |

| 📈 Maximum Trade Size | 60 Standard lots per position |

| 💸 Maximum Open Orders | 500 |

| 📞 Margin Call (%) | 50 |

| 🛑 Stop-Out (%) | 20 |

| 💵 Account Base Currency | USD, ZAR, NGN |

| 👥 Personal Account Manager | Yes |

| 💵 Commission Charges | From between $3 for Major Forex Pairs and $4 on other instruments per lot traded |

| ✔️ Bonuses Offered | None |

Auto Account

| Account Feature | Value |

| 💸 Minimum Deposit | 720,000 UGX or an equivalent to $200 or R2,800 |

| 📊 Spreads | From 1 pip EUR/USD |

| 💻 Trading Platform | MetaTrader 4 |

| 🔧 Trading Instruments | Forex, Spot Indices, Gold, Spot Energies, BTC/USD, BTC/EUR |

| 📲 Execution | Market Execution |

| 💰 Maximum Leverage Ratio | 1:500 |

| 📉 Minimum Trade Size | 0.01 lot |

| 📈 Maximum Trade Size | 60 Standard lots per position |

| 💸 Maximum Open Orders | 300 |

| 📞 Margin Call (%) | 50 |

| 🛑 Stop-Out (%) | 20 |

| 💵 Account Base Currency | USD |

| 👥 Personal Account Manager | Yes |

| 💵 Commission Charges | None |

| ✔️ Bonuses Offered | None |

HF Markets Base Account Currencies

HF Markets Demo Account

HF Markets Islamic Account

How to open an Account with HF Markets

How to Register An Account

HotForex VS GlobalGT VS OspreyFX – Broker Comparison

| HotForex | GlobalGT | OspreyFX | |

| ⚖️ Regulation | FSCA, CySEC, DFSA, FSA, FCA, FSC, CMA with registration in ACPR, BaFin, MNB, CONSOB, CNMV, FI, FMA, FSC, and other regions | FSCA, FSA | None |

| 📱 Trading Platform | • MetaTrader 4 • MetaTrader 5 | • MetaTrader 5 | • MetaTrader 4 • MetaTrader 5 |

| 💰 Withdrawal Fee | No | No | No |

| 📊 Demo Account | Yes | Yes | Yes |

| 📈 Minimum Deposit | 18,000 UGX | 18,000 UGX | 97,000 UGX |

| 📈 Leverage | 1:1000 | 1:1000 | 1:500 |

| 📊 Spread | 0.0 pips | From 0.0 pips | From 0.4 pips |

| 💰 Commissions | $3 to $4 | $10 | From $1 |

| ✴️ Margin Call/Stop-Out | • 40%/10% • 50%/20% | 80%/50% | 100%/70% |

| ✴️ Order Execution | Market | Market | Market |

| 💳 No-Deposit Bonus | No | No | No |

| 📊 Cent Accounts | No | Yes | No |

| 📈 Account Types | • Micro Account • Premium Account • Kenya HFcopy Account • Kenya Zero Spread Account • Auto Account | • Cent Account • Mini Account • Standard Account • Standard FX Account • ECN Account | • Standard Account • PRO Account • VAR Account • Mini Account |

| ⚖️ CMA Regulation | No | No | No |

| 💳 UGX Deposits | Yes | Yes | No |

| 📊 UGX Account | No | No | No |

| 👥 Customer Service Hours | 24/5 | 24/7 | 24/7 |

| 📊 Retail Investor Accounts | 5 | 5 | 4 |

| ☪️ Islamic Account | Yes | No | Yes |

| 💸 Minimum Trade Size | 0.01 lots | 0.01 lots | 0.01 lots |

| 📈 Maximum Trade Size | 60 lots | 500 lots | 1,000 lots |

Min Deposit

USD 5 / 18,000 UGX

Regulators

CySEC, FSC, FSCA

Trading Desk

MetaTrader 4 and MetaTrader 5

Crypto

No

Total Pairs

50+

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

HF Markets Trading Platforms

Desktop Platforms

MetaTrader 4 and 5

WebTrader Platforms

MetaTrader 4 and 5

Trading App

MetaTrader 4 and 5

HF App

HF Markets Range of Markets

Broker Comparison for Range of Markets

| HotForex | Global GT | OspreyFX | |

| ➡️️ Forex | Yes | Yes | Yes |

| ➡️️ Precious Metals | Yes | Yes | Yes |

| ➡️️ ETFs | No | No | No |

| ➡️️ CFDs | Yes | Yes | Yes |

| ➡️️ Indices | Yes | Yes | Yes |

| ➡️️ Stocks | Yes | Yes | Yes |

| ➡️️ Cryptocurrency | Yes | Yes | Yes |

| ➡️️ Options | No | No | No |

| ➡️️ Energies | Yes | Yes | Yes |

| ➡️️ Bonds | Yes | No | No |

Min Deposit

USD 5 / 18,000 UGX

Regulators

CySEC, FSC, FSCA

Trading Desk

MetaTrader 4 and MetaTrader 5

Crypto

No

Total Pairs

50+

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

HF Markets Trading and Non-Trading Fees

Spreads

Commissions

Overnight Fees, Rollovers, or Swaps

Deposit and Withdrawal Fees

Inactivity Fees

Currency Conversion Fees

HF Markets Deposits and Withdrawals

How to Deposit Funds with HF Markets

HF Markets Fund Withdrawal Process

HF Markets Education and Research

Education

HF Markets Bonuses and Promotions

How to open an Affiliate Account with HF Markets

HF Markets Affiliate Program Features

HF Markets Customer Support

HF Markets Corporate Social Responsibility

Verdict on HF Markets

HF Markets Current Popularity Trends

👉 According to Google Trends, HF Markets has seen an increase in Google Searches in the past month.

HF Markets Pros and Cons

| ✔️ Pros | ❌ Cons |

| There is a low minimum deposit requirement when Ugandans register an account | There is no UGX-denominated trading account |

| Ugandans can expect tight spreads that start from 0.0 pips on the Zero Spread Account offered by HF Markets | There are no local deposit or withdrawal options offered to Ugandan traders |

| There is a choice between several account types that cater to different Ugandan traders | There is an inactivity fee and currency conversion fee charged |

| HF Markets is extremely well-regulated and has a good reputation in the industry | There is a limited choice between payment methods supported by HF Markets for deposits and withdrawals |

| There is investor protection offered and all client funds are segregated | |

| Copy and Social trading is available through HF Markets | |

| HF Markets accepts all types of strategies and provides traders with a range of trading tools to refine their trading | |

| There is an unlimited demo account with 100,000 in virtual funding that can be topped up |

Min Deposit

USD 5 / 18,000 UGX

Regulators

CySEC, FSC, FSCA

Trading Desk

MetaTrader 4 and MetaTrader 5

Crypto

No

Total Pairs

50+

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Frequently Asked Questions

Is HF Markets a good broker?

Yes, HF Markets is a good broker. Overall, HF Markets can be summed up as a reliable and secure broker providing 24/5 multilingual customer support, a choice in retail investor accounts, robust trading technology, and more. HF Markets has a trust score of 85 out of 100, making it a low risk and high trust broker.

Is HF Markets regulated?

Yes, HF Markets is regulated and authorized by the FCA (Tier-1, low-risk), CySEC (Tier-2, average risk), FSCA (Tier-2, average risk), DFSA (Tier-2 average risk), CMA (Tier-2, average risk), FSA (Tier-3, high risk), and FSC (Tier-3, high risk).

What is the minimum deposit with HF Markets?

The minimum deposit with HF Markets is 18,000 UGX, $5, or 70 ZAR on a Micro Account, which is the entry-level retail account offered by the broker.

What is the withdrawal time for HF Markets?

The withdrawal time for HF Markets is up to 10 minutes on Skrill, up to 2 working days on Electronic Transfer, and between 2 to 10 working days on Bank Wire and Debit/Credit Cards.

Does HF Markets have Nasdaq?

Yes, HF Markets offers Nasdaq as part of its comprehensive list of indices that can be traded on the spot and futures markets. With HF Markets, you can trade Nasdaq with spreads that start from 2 pips and with leverage up to 1:200 (in all regions other than the UK and EU, which are limited to 1:30).

What is the minimum withdrawal on HF Markets?

The minimum withdrawal on HF Markets is 5 USD on Credit/Debit Cards and Skrill.

Does HF Markets allow Expert Advisors?

Yes, HF Markets allows EAs. When traders register a Zero Spread account, they will find the perfect solution that offers trading conditions that are suitable for scalpers, high-volume traders, and Ugandan traders who prefer using Expert Advisors (EAs).

Does HF Markets have Volatility 75?

Yes, HF Markets has Volatility 75. With HF Markets, you can trade VIX.F as a Futures Contract with spreads from 0.14 pips and using leverage up to a maximum of 1:100.

Is HF Markets safe or a scam?

HF Markets is not a scam but a safe broker. HF Markets has a strict regulatory framework that consists of Tier-1, Tier-2, and Tier-3 market regulators who oversee its operations. In addition, HF Markets is frequently audited, and all client funds are kept with top-tier financial institutions.

Conclusion

Addendum/Disclosure:

Table of Contents