GO Markets Review

Overall, GO Markets is considered low-risk, with an overall Trust Score of 98 out of 100. GO Markets is licensed by one Tier-1 Regulator (high trust), one Tier-2 Regulator (average trust), and two Tier-3 Regulators (low trust). GO Markets offers two different retail trading accounts namely a Standard Account and a GO+ Account. GO Markets is currently not regulated by the CMA of Uganda

- Louis Schoeman

Jump to:

Regulation and Safety of Funds

Account Types and Features

Account Registration

Trading Platforms

Range of Markets

Fees

Deposits and Withdrawals

Education and Research

Affiliate Program

Final Verdict

Pros and Cons

FAQ

Min Deposit

USD 200 / 490,000 UGX

Regulators

ASIC, CySec, FSC, FSA and SCA

Trading Desk

Hybrid

Crypto

Yes

Total Pairs

60

Islamic Account

No

Trading Fees

Low

Account Activation Time

24 Hours

GO Markets Review – 25 key points quick overview:

GO Markets Overview

GO Markets At a Glance

GO Markets Regulation and Safety of Funds

- GO Markets Awards and Recognition

- GO Markets Account Types and Features

- How to open an Account with GO Markets

- GO Markets Vs BDSwiss Vs Fidelity Investments – Broker Comparison

- GO Markets Trading Platforms

- GO Markets Range of Markets

- Broker Comparison for Range of Markets

- GO Markets Trading and Non-Trading Fees

- GO Markets Deposits and Withdrawals

- How to Deposit Funds with GO Markets

- GO Markets Fund Withdrawal Process

- GO Markets Education and Research

- GO Markets Bonuses and Promotions

- How to open an Affiliate Account with GO Markets

- GO Markets Affiliate Program Features

- GO Markets Customer Support

- GO Markets Corporate Social Responsibility

- Verdict on GO Markets

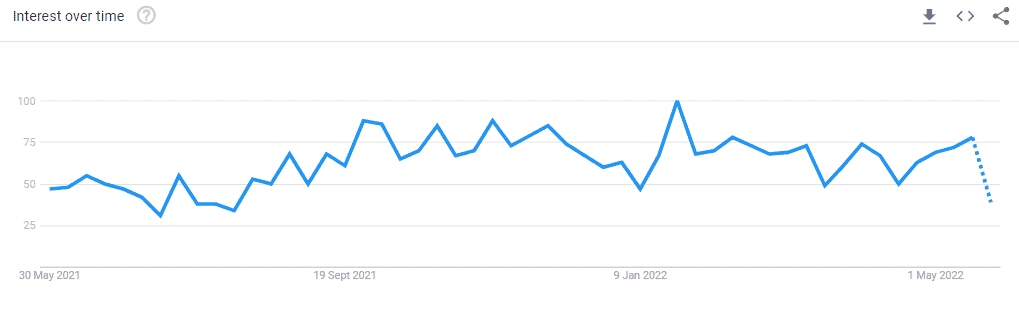

- GO Markets Current Popularity Trends

- GO Markets Pros and Cons

- Frequently Asked Questions

- Conclusion

GO Markets Overview

GO Markets Distribution of Traders

👉 GO Markets currently has the largest market share in these countries:

➡️️ Australia – 31.5%

➡️️ Philippines – 9.5%

➡️️ United Kingdom – 6.8%

➡️️ Vietnam – 5.6%

➡️️ Brazil – 5.3%

Popularity among traders who choose GO Markets

🥇 GO Markets is a safe and well-regulated CFD and Forex broker that serves global clients. While GO Markets does not occupy a large market share in Uganda, the broker is still suited for Ugandan traders, making it one of the Top 50 brokers for the region.

GO Markets At a Glance

| 🏛 Headquartered | Australia |

| 🏙 Local office in Kampala? | No |

| ✅ Accepts Uganda traders? | Yes |

| 🗓 Year Founded | 2006 |

| 📞 Uganda Office Contact Number | None |

| 🤳 Social Media Platforms | • Facebook • YouTube |

| ⚖️ Regulation | ASIC, FSA Seychelles, FSC Mauritius, CySEC |

| 🪪 License Number | • Australia – ABN 24 653 400 527, AFSL 254963 • Seychelles – SD043 • Mauritius – GB 19024896 • Cyprus – 322/17 |

| ⚖️ CMA Uganda Regulation | No |

| 🚫 Regional Restrictions | USA, Canada, New Zealand, Belgium, Japan, Israel, Turkey, Vietnam, Puerto Rico, Afghanistan, Azerbaijan, Bosnia and Herzegovina, Burundi, Central African Rep, Congo, Cote D’Ivoire , Ethiopia, Eritrea, Egypt, Gaza Strip, Haiti, Iran, Iraq, Lebanon, Libya, Myanmar, North Korea, Pakistan, Serbia, Sierra Leone, Somalia, Sri Lanka, Sudan, South Sudan, Syria, Trinidad and Tobago, Tunisia, West Bank, Ukraine, Vanuatu, Venezuela, Yemen, Zimbabwe. |

| ☪️ Islamic Account | No |

| 💻 Demo Account | Yes |

| 🛍 Retail Investor Accounts | 2 |

| 📊 PAMM Accounts | No |

| 🤝 Liquidity Providers | Over 22 liquidity providers |

| 💸 Affiliate Program | Yes |

| 📲 Order Execution | Instant |

| 📊 Average spread | From 0.0 pips |

| 📞 Margin Call | 80% |

| 🛑 Stop-Out | 50% |

| ✅ Crypto trading offered? | 0.01 lots |

| 💰 Offers a UGX Account? | No |

| 👨💻 Dedicated Uganda Account Manager? | No |

| 📊 Maximum Leverage | 1:500 |

| 🚫 Leverage Restrictions for Uganda? | None |

| 💰 Minimum Deposit | 490,000 UGX equivalent to AU$200 |

| ✅ Uganda Shilling Deposits Allowed? | No |

| 📊 Active Uganda Trader Stats | 100,000+ |

| 👥 Active Uganda-based GO Markets customers | Unknown |

| 💳 Uganda Daily Forex Turnover | Unknown, overall Forex Daily Trading Volume is over $6.6 Trillion |

| 💵 Deposit and Withdrawal Options | • Credit Card • Debit Card • Skrill • Neteller • Bank Wire Transfer • Fasapay |

| 🏦 Segregated Accounts with Uganda Banks? | No |

| 📊 Trading Platforms | • MetaTrader 4 • MetaTrader 5 |

| ✔️ Tradable Assets | • Forex CFDs • Share CFDs • Index CFDs • Metal CFDs • Commodity CFDs |

| 💸 Offers USD/UGX currency pair? | No |

| 📈 USD/UGX Average Spread | N/A |

| 📉 Offers Uganda Stocks and CFDs | None |

| 🗣 Languages supported on Website | English, Spanish, Italian, Portuguese, Arabic, Indonesian, Thai |

| 📞 Customer Support Languages | Multilingual |

| ⏰ Customer Service Hours | 24/5 |

| 👥 Uganda-based customer support? | No |

| ✅ Bonuses and Promotions for Uganda traders | None |

| 📚 Education for Uganda beginner traders | Yes |

| 📱 Proprietary trading software | No |

| 💰 Most Successful Ugandan Trader | Unknown |

| ✅ Is GO Markets a safe broker for Ugandans? | Yes |

| 📊 Rating for GO Markets Uganda | 8/10 |

| 🤝 Trust score for GO Markets Uganda | 98% |

| 👉 Open an account | 👉 Open Account |

GO Markets Regulation and Safety of Funds

GO Markets Regulation in Uganda

GO Markets Global Regulations

➡️ Australia – GO Markets Securities Pty Ltd is registered as an Australian Private Company under ABN 24 653 400 5277, receiving licensing in September 2021. In addition, GO Markets Pty Ltd has an Australian Financial Services License under AFSL 254963, providing the broker with the necessary authorization to provide financial services.

➡️ Seychelles – GO Markets International Ltd is registered as a securities dealer in Seychelles.

➡️ Mauritius – GO Markets Pty Ltd (MU) is registered in Mauritius with FSC number GB 19024896.

➡️ Cyprus – GO Markets Ltd is registered in Limassol as an Investment Services entity under the license number 322/17.

GO Markets Client Fund Security and Safety Features

GO Markets Awards and Recognition

GO Markets Account Types and Features

➡️ Standard Account

➡️ GO+ Account

GO Markets Live Trading Accounts

Standard Account

| Account Feature | Value |

| 💰 Minimum Deposit | 490,000 UGX equivalent to AU$200 |

| 👥 Access to an Account Manager | Yes |

| 💸 Commission Charges | None |

| 📊 Average Spread | Variable, from 1 pip |

| ✔️ Markets Offered | 50+ FX Pairs, Shares, Indices, Commodities & Cryptocurrencies |

| 📈 Maximum Leverage offered | 1:500 |

| 🔧 Access to Trading Tools | Yes |

| 💵 Base Account Currencies | AUD, USD, EUR, GBP, NZD, CAD, SGD, CHF, HKD |

| 📞 Expert Advisors | Yes |

| ✔️ Scalping Allowed? | Yes |

| 🆓 Free VPS offered? | Yes |

GO+ Account

| Account Feature | Value |

| 💰 Minimum Deposit | 490,000 UGX equivalent to AU$200 |

| 👥 Access to an Account Manager | Yes |

| 💸 Commission Charges | AU$3 per side on a standard lot |

| 📊 Average Spread | Variable, from 0.0 pips |

| ✔️ Markets Offered | 50+ FX Pairs, Shares, Indices, Commodities & Cryptocurrencies |

| 📈 Maximum Leverage offered | 1:500 |

| 🔧 Access to Trading Tools | Yes |

| 💵 Base Account Currencies | AUD, USD, EUR, GBP, NZD, CAD, SGD, CHF, HKD |

| 📞 Expert Advisors | Yes |

| ✔️ Scalping Allowed? | Yes |

| 🆓 Free VPS offered? | Yes |

GO Markets Demo Account

GO Markets Islamic Account

How to open an Account with GO Markets

👉 Step 1 – Go to The Official Website

➡️ Go to the official GO Markets website and click on “Open Live Account”.

👉 Step 2 – Fill Out Your Details

➡️ Fill out your personal information such as your country of residence, first and last name, email address, and create a password for your account.

Min Deposit

USD 200 / 490,000 UGX

Regulators

ASIC, CySec, FSC, FSA and SCA

Trading Desk

Hybrid

Crypto

Yes

Total Pairs

60

Islamic Account

No

Trading Fees

Low

Account Activation Time

24 Hours

GO Markets Vs BDSwiss Vs Fidelity Investments – Broker Comparison

| GO Markets | BDSwiss | Fidelity Investments | |

| ⚖️ Regulation | ASIC, FSA Seychelles, FSC Mauritius, CySEC | CySEC, FSC, BaFIN, FSA | FINRA, SEC |

| 📱 Trading Platform | • MetaTrader 4 • MetaTrader 5 | • MetaTrader 4 • MetaTrader 5 • BDSwiss Mobile • BDSwiss Web | • Active Trader Pro • Fidelity Mobile |

| 💰 Withdrawal Fee | No | Yes, <100 EUR withdrawals | No |

| 📊 Demo Account | Yes | Yes | Yes |

| 📈 Minimum Deposit | 490,000 UGX | 375,000 UGX | 3,302 UGX |

| 📈 Leverage | Up to 1:500 | Up to 1:1000 | 1:1 |

| 📊 Spread | From 0.0 pips | From 0.3 pips | None |

| 💰 Commissions | From US$2.50 | $2 to $5 | $0 to $0.03 |

| ✴️ Margin Call/Stop-Out | 80%/50% | 50%/20% | None |

| ✴️ Order Execution | Instant | Market/Instant | None |

| 💳 No-Deposit Bonus | No | No | No |

| 📊 Cent Accounts | No | In Progress | No |

| 📈 Account Types | • Standard Account • GO+ Account | • Classic Account • Premium Account • VIP Account • RAW Account | • Brokerage Account • Cash Management Account • Brokerage and Cash Management • The Fidelity Account for Businesses • Fidelity Go, and several others |

| ⚖️ CMA Regulation | No | No | No |

| 💳 UGX Deposits | No | No | No |

| 📊 Uganda Shilling Account | No | No | No |

| 👥 Customer Service Hours | 24/5 | 24/5 | 24/7 |

| 📊 Retail Investor Accounts | 2 | 4 | 15 |

| ☪️ Islamic Account | No | Yes | No |

| 📉 Minimum Trade Size | 0.01 lots | 0.01 lots | 0.01 lots |

| 📈 Maximum Trade Size | 250 lots | 1,000 lots | 4x maintenance margin excess |

GO Markets Trading Platforms

👉 GO Markets offers Ugandan traders a choice between these trading platforms:

➡️ MetaTrader 4 Desktop

➡️ MetaTrader 5 Desktop

Desktop Platforms

➡️ MetaTrader 4 Desktop

➡️ MetaTrader 5 Desktop

MetaTrader 4

👉 Millions of traders throughout the world use MT4 as their primary trading platform. Because of its simple and pleasant design, the platform is attractive to traders of all levels, regardless of their experience.

👉 From as early as 2006, GO Markets was among the first online brokers to provide MetaTrader 4 (MT4) to Australia. Since then, several MT4 tools, such as MT4 Genesis, have been introduced to further enhance the platform.

👉 It contains a wide range of features that provide for a simple and comfortable trading environment, with built-in tools that assist to increase trade efficiency.

MetaTrader 5

👉 In addition to a depth of market (DOM) and an order and transaction accounting system, the MT5 platform offers a robust trading platform. In addition to classic netting, it also supports the hedging option mechanism.

👉 Instant, Request, Market and Exchange order execution modalities are provided to satisfy a variety of trading goals. All sorts of trading orders are supported by MT5 including Market, pending, stop, and trailing stop orders.

WebTrader Platforms

➡️ MetaTrader 4 Desktop

➡️ MetaTrader 5 Desktop

MetaTrader 4

👉 Most recent web browsers can run the web platform without the requirement for any extra software to execute. MetaTrader 4’s features include:

➡️ Instant quotations on a wide range of financial instruments.

➡️ Trading numerous marketplaces at the same time.

➡️ Multiple chart timeframes.

➡️ One-click trading with many order types and alerts through SMS and email.

➡️ Automated trading with the use of expert advisers (EAs).

➡️ Backtesting EAs on historical data using a strategy tester.

➡️ For chart analysis, there are several built-in technical indicators and graphical elements.

➡️ Indicator and EA MetaEditor for MQL programming language.

➡️ Community and marketplace for MQL products may be accessed directly from the platform.

👉 In addition, if you are just getting started with MT4, GO Markets has a variety of instructions and videos that can get you up and running. Tutorials include a wide range of subjects, from platform features and tools to functionality and user experience.

MetaTrader 5

👉 MT5 is a multi-functional, sleek, and user-friendly platform. It is the successor to MT4 that preserves most of the essential features with some extra capabilities for extensive price analysis, automatic trading, and copy trading.

👉 When it comes to market analysis, the built-in analytical features of MT5 are excellent. There are no limits on the number of open charts that it can handle. When it comes to chart analysis, there are 21 periods to choose from (compared to MT4’s 9 timeframes).

👉 You get access to more than 80+ technical indicators and analytical tools. The MQL marketplace also provides access to hundreds of other tools, such as custom indicators, EAs, and signals.

Trading App

➡️ MetaTrader 4

➡️ MetaTrader 5

MetaTrader 4 and 5

👉 Trades may be made on the go using GO Markets’ mobile trading platforms, which can be accessed through an Android or iPhone compatible MetaTrader app. Traders may use MT4 and MT5 for Mobile to trade Forex, indices, commodities, and more.

👉 The MT4 and MT5 mobile apps make it possible for Ugandans to trade at any time, from any location, using a range of trading apps. Ugandans can also:

➡️ View comprehensive trade execution speed and real-time quotes.

➡️ Manage, execute, and conclude transactions.

➡️ Access than 25 technical indicators.

➡️ Make use of a comprehensive economic calendar.

GO Markets Range of Markets

👉 Ugandan traders can expect the following range of markets from GO Markets:

➡️ Forex CFDs

➡️ Share CFDs

➡️ Index CFDs

➡️ Metal CFDs

➡️ Commodity CFDs

Broker Comparison for Range of Markets

| GO Markets | BDSwiss | Fidelity Investments | |

| ➡️️ Forex | Yes | Yes | No |

| ➡️️ Precious Metals | Yes | Yes | No |

| ➡️️ ETFs | No | No | Yes |

| ➡️️ CFDs | Yes | Yes | No |

| ➡️️ Indices | Yes | Yes | No |

| ➡️️ Stocks | Yes | Yes | Yes |

| ➡️️ Cryptocurrency | No | Yes | No |

| ➡️️ Options | No | No | Yes |

| ➡️️ Energies | Yes | Yes | No |

| ➡️️ Bonds | No | No | Yes |

GO Markets Trading and Non-Trading Fees

Spreads

👉 The average spreads that traders might anticipate from GO Markets are as follows:

➡️ AUD/USD – From 0.1 pips

➡️ USD/CAD – From 0.2 pips

➡️ EUR/USD – From as low as 0.0 pips with an average of 0.1 pips

➡️ USD/JPY – From 0.2 pips

➡️ USD/CHF – from 0.3 pips

➡️ GBP/USD – from 0.2 pips

Commissions

👉 There are no commission fees for the Standard account, but the following fees are applied to the GO+ account depending on the base currency selections as follows:

➡️ Australian Dollar (AUD) – AU$3.00

➡️ Euro (EUR) – €2.00

➡️ Great British Pound (GBP) – £2.00

➡️ New Zealand Dollar (NZD) – NZ$3.50

➡️ United States Dollar (USD) – US$2.50

➡️ Singapore Dollar (SGD) – SG$3.50

➡️ Swiss Franc (CHF) – FR$2.50

➡️ Canadian Dollar (CAD) – CA$3.00

➡️ Hong Kong Dollar (HKD) – HK$20

Overnight Fees, Rollovers, or Swaps

👉 Ugandan traders who hold positions open for longer than 24 hours can expect overnight fees. Whether they are deducted or refunded will depend on the position that the trader holds (whether long or short). In addition, the fees are determined by interbank rates, the financial instrument, position size, and how long the position is held.

👉 Some typical overnight fees that Ugandan traders can expect from GO Markets are as follows:

➡️ EUR/CHF – -0.178 short swap and -0.073 long swap

➡️ EUR/USD – 0.085 short swap and -0.378 long swap

Deposit and Withdrawal Fees

👉 There are no deposit or withdrawal fees charged by GO Markets. However, Ugandan traders can expect some processing fees from their payment provider depending on the deposit/withdrawal method they use.

Inactivity Fees

👉 GO Markets does not charge any fees or penalties when a live trading account becomes dormant after an extended period.

Currency Conversion Fees

👉 If Ugandans deposit or withdraw funds with GO Markets in any currency other than their set base account currency, they will face currency conversion fees.

GO Markets Deposits and Withdrawals

➡️ Credit Card

➡️ Debit Card

➡️ Skrill

➡️ Neteller

➡️ Bank Wire Transfer

➡️ Fasapay

How to Deposit Funds with GO Markets

➡️ To deposit cash Traders from Uganda can log in to the GO Markets Client Portal.

➡️ From here, they can choose a preferred deposit option.

➡️ Next, traders can choose their chosen deposit method and provide the amount that they want to deposit.

➡️ Lastly, traders can follow any additional instructions that are required by their payment provider to confirm and finalize the deposit.

GO Markets Fund Withdrawal Process

➡️ Log into the Client Portal and choose “Withdrawal” to begin the withdrawal process.

➡️ Click “Confirm” once you have selected your chosen method and entered the desired withdrawal amount.

GO Markets Education and Research

Education

➡️ GO Trade Academy

➡️ Introduction to Forex

➡️ Tutorials – MetaTrader 4 Video Tutorials

➡️ AutoChartist

➡️ MT4 and 5 Genesis

➡️ VPS

➡️ a-Quant

➡️ Social Trading through MyFXBook

➡️ Trading Central

➡️ Daily News

➡️ Weekly Summaries

➡️ Articles

➡️ Economic Calendar

GO Markets Bonuses and Promotions

How to open an Affiliate Account with GO Markets

➡️ Ugandans can visit the GO Markets website and look for the “Affiliates” option at the very top of the GO Markets homepage.

➡️ A new page will load, and prospective affiliates can click on the green “Sign Up Now” banner to start the process.

➡️ Ugandans can create their affiliate account by completing the online form that will capture all the necessary details.

➡️ Once complete, the form can be submitted and GO Markets will be in touch regarding the outcome of the application.

GO Markets Affiliate Program Features

GO Markets Customer Support

GO Markets Corporate Social Responsibility

Verdict on GO Markets

GO Markets Current Popularity Trends

👉 According to Google Trends, GO Markets has seen an increase in Google Searches in the past month.

Min Deposit

USD 200 / 490,000 UGX

Regulators

ASIC, CySec, FSC, FSA and SCA

Trading Desk

Hybrid

Crypto

Yes

Total Pairs

60

Islamic Account

No

Trading Fees

Low

Account Activation Time

24 Hours

GO Markets Pros and Cons

| ✔️ Pros | ❌ Cons |

| There are zero-pip spreads offered on the GO+ Account with competitive commissions | There are only two trading accounts available to Ugandan traders and no option to make UGX the base currency |

| The Standard Account is the commission-free account for Ugandan traders | There is no option to convert a live trading account into an Islamic account |

| There are several trading and analysis tools including AutoCharist, Trading Central, a-Quant, and others | There are no local deposit or withdrawal options offered to Ugandan traders |

| Both MetaTrader 4 and 5 are available to Ugandan traders | The minimum deposit required by GO Markets is much higher than other brokers |

| There is no inactivity fee and no fees on deposits or withdrawals | |

| There are instant deposits and withdrawals offered on several payment providers | |

| There is award-winning customer support offered to Ugandan traders | |

| There is adequate leverage up to 1:500 offered |

Frequently Asked Questions

What can I trade with GO Markets?

You can trade between 400 and 600 financial instruments that range from forex, Index CFDs, Share CFDs, Precious Metal CFDs, Commodity CFDs, and more.

What is GO Markets?

GO Markets is an Australian-based STP and ECN brokerage firm that has been in operation since 2006. GO Markets caters for traders from around the world (except for several regions as indicated on the official website) and offers two account types, leverage up to 1:500, and a trading environment protected by regulations through ASIC, CySEC, FSC, and FSA.

Is GO Markets regulated?

Yes, GO Markets operates through entities in Australia, Cyprus, Mauritius, and Seychelles and the broker has regulations through the respective ASIC, CySEC, FSC, and FSA in these regions.

What is the withdrawal time for GO Markets?

The processing time for withdrawal requests at GO Markets is normally between one and two business days. However, Ugandan traders should factor in additional time for their payment providers or other processes.

Does GO Markets have Nasdaq?

Yes, Ugandan traders will find that GO Markets offers Index CFDs on Nasdaq and offers shares that are listed on Nasdaq which can be traded as CFDs.

Does GO Markets have Volatility 75?

No, GO Markets does not offer VIX as a CFD trading instrument.

Where is GO Markets based?

GO Markets is headquartered in Australia but operates entities in Cyprus, Mauritius, and Seychelles.

Is GO Markets safe or a scam?

According to the regulatory status, low-risk status, and high trust score of GO Markets, the broker is considered a safe option for Ugandan traders.

How can you withdraw money from GO Markets?

You can log into your client area or trading platform and select the option to withdraw. To submit a withdrawal request you must have enough free capital in your account, and you must complete the request according to your payment provider. Once your request has been submitted and approved, the funds will be transferred to your banking account.

Conclusion

➡️ Do you have any prior experience with GO Markets?

➡️ What was the determining factor in your decision to engage with GO Markets?

➡️ Was it because of the minimum deposit, regulation, retail trading accounts, or any other factors?

➡️ Have you experienced any issues with GO Markets such as difficulty withdrawing funds, inability to verify regulations, irresponsive customer support, etc.?

Addendum/Disclosure:

Table of Contents