IC Markets Review

Overall, IC Markets is considered low-risk, with an overall Trust Score of 86 out of 100. IC Markets is licensed by one Tier-1 Regulators (high trust), one Tier-2 Regulator (average trust), and two Tier-3 Regulators (low trust). IC Markets offers three different retail trading accounts namely a cTrader Account, Raw Spread Account, and Standard Account. IC Markets is currently not regulated by the CMA of Uganda

- Louis Schoeman

Jump to:

Regulation and Safety of Funds

Account Types and Features

Account Registration

Trading Platforms

Range of Markets

Fees

Deposits and Withdrawals

Education and Research

Affiliate Program

Final Verdict

Pros and Cons

FAQ

Min Deposit

USD 200 / 718,000 UGX

Regulators

ASIC

Trading Desk

Metatrader 4

Crypto

Yes

Total Pairs

65

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

IC Markets Review – 25 key points quick overview:

IC Markets Overview

IC Markets At a Glance

IC Markets Regulation and Safety of Funds

- IC Markets Awards and Recognition

- Account Types and Features

- How to open an Account with IC Markets

- IC Markets Vs NinjaTrader Vs eToro – Broker Comparison

- IC Markets Trading Platforms

- IC Markets Range of Markets

- Broker Comparison for Range of Markets

- IC Markets Trading and Non-Trading Fees

- IC Markets Deposits and Withdrawals

- How to Deposit Funds with IC Markets

- IC Markets Fund Withdrawal Process

- IC Markets Education and Research

- IC Markets Bonuses and Promotions

- How to open an Affiliate Account with IC Markets

- IC Markets Affiliate Program Features

- IC Markets Customer Support

- IC Markets Corporate Social Responsibility

- Verdict on IC Markets

- IC Markets Current Popularity Trends

- IC Markets Pros and Cons

- Frequently Asked Questions

- Conclusion

IC Markets Overview

IC Markets Distribution of Traders

👉 IC Markets currently has the largest market share in these countries:

➡️️ Vietnam – 11.7%

➡️️ Brazil – 8.9%

➡️️ United Kingdom – 6.5%

➡️️ Poland – 5.6%

➡️️ Australia – 3.9%

Popularity among traders who choose IC Markets

🥇 IC Markets is an Australian-based broker that offers global trading solutions to traders and while IC Markets does not have a large market share in Uganda, the broker is still part of the Top 50 brokers for Ugandan traders today.

IC Markets At a Glance

| 🏛 Headquartered | Sydney, Australia |

| 🏙 Local office in Kampala? | No |

| ✅ Accepts Uganda traders? | Yes |

| 🗓 Year Founded | 2007 |

| 📞 Uganda Office Contact Number | None |

| 🤳 Social Media Platforms | • Facebook |

| ⚖️ Regulation | ASIC, CySEC, FSA, SCB |

| 🪪 Regulatory Licenses | • Seychelles – SD018 • Australia – AFSL 335692 • Cyprus – 362/18 • Bahamas – SIA-F214 |

| ⚖️ CMA Uganda Regulation | No |

| 🚫 Regional Restrictions | United States, Canada, Iran, Yemen, and OFAC countries |

| ☪️ Islamic Account | Yes |

| 💻 Demo Account | Yes |

| 🛍 Retail Investor Accounts | 3 |

| 📊 PAMM Accounts | MAM Accounts |

| 🤝 Liquidity Providers | 25 |

| 💸 Affiliate Program | Yes |

| 📲 Order Execution | Market |

| 📊 Average spread | From 0.0 pips |

| 📞 Margin Call | 100% |

| 🛑 Stop-Out | 50% |

| ✅ Crypto trading offered? | Yes |

| 💰 Offers a UGX Account? | No |

| 👨💻 Dedicated Uganda Account Manager? | No |

| 📊 Maximum Leverage | 1:500 |

| 🚫 Leverage Restrictions for Uganda? | No |

| 💰 Minimum Deposit | 718,000 UGX or an equivalent to $200 |

| ✅ Uganda Shilling Deposits Allowed? | No |

| 📊 Active Uganda Trader Stats | 100,000+ |

| 👥 Active Uganda-based IC Markets customers | Unknown |

| 💳 Uganda Daily Forex Turnover | Unknown, overall Forex Daily Trading Volume is over $6.6 Trillion |

| 💵 Deposit and Withdrawal Options | • Credit Card • Debit Card • PayPal • Neteller • Neteller VIP • Skrill • UnionPay • Bank Wire Transfer • Bpay • FasaPay • Broker to Broker • POLi • Thai Internet Banking • Vietnamese Internet • Banking • Rapidpay • Klarna |

| 🏦 Segregated Accounts with Uganda Banks? | No |

| 📊 Trading Platforms | • MetaTrader 4 • MetaTrader 5 • cTrader |

| ✔️ Tradable Assets | • Forex • Commodities • Indices • Bonds • Cryptocurrencies • Stocks • Futures |

| 💸 Offers USD/UGX currency pair? | No |

| 📈 USD/UGX Average Spread | N/A |

| 📉 Offers Uganda Stocks and CFDs | None |

| 🗣 Languages supported on Website | English, Spanish, Russian, Thai, Malay, Vietnamese, Italian, Portuguese, and several others |

| 📞 Customer Support Languages | Multilingual |

| ⏰ Customer Service Hours | 24/7 |

| 👥 Uganda-based customer support? | No |

| ✅ Bonuses and Promotions for Uganda traders | No |

| 📚 Education for Uganda beginner traders | Yes |

| 📱 Proprietary trading software | No |

| 💰 Most Successful Ugandan Trader | Unknown |

| ✅ Is IC Markets a safe broker for Ugandan traders? | Yes |

| 📊 Rating for IC Markets Uganda | 9/10 |

| 🤝 Trust score for IC Markets Uganda | 85% |

| 👉 Open an account | 👉 Open Account |

IC Markets Regulation and Safety of Funds

IC Markets Regulation in Uganda

IC Markets Global Regulations

IC Markets Client Fund Security and Safety Features

IC Markets Awards and Recognition

Account Types and Features

➡️ cTrader Account

➡️ Raw Spread Account

➡️ Standard Account

IC Markets Live Trading Accounts

cTrader Account

| Account Feature | Value |

| 💻 Trading Platform | cTrader |

| 💸 Commission | $3 per side and $6 per round turn |

| 📊 Typical Average Spreads | 0.0 pips |

| 💵 Minimum Deposit Requirement | 718,000 UGX or an equivalent to $200 |

| 📈 Leverage | 1:500 |

| 📱 Maximum positions per account | 2,000 |

| 📍 Server Location | London |

| 💳 Micro trading allowed? | Yes |

| 📉 Currency Pairs | 64 |

| 📊 Index CFD Trading | Yes |

| 📞 Margin Call | 100% |

| 🛑 Stop-out | 50% |

| 👆 One-Click Trading offered? | Yes |

| ☪️ Islamic Accounts | Yes |

| ✔️ Trading Styles accepted | Scalping, hedging, expert advisors, algorithmic strategies, etc. |

| 👥 Programming Language | C# |

| ✔️ Suitable for | Day traders, scalpers, active traders |

| 💵 Demo Account offered? | Yes |

Raw Spread Account

| Account Feature | Value |

| 💻 Trading Platform | MetaTrader 4 and 5 |

| 💸 Commission | $3.5 per side and $7 per round turn |

| 📊 Typical Average Spreads | 0.0 pips |

| 💵 Minimum Deposit Requirement | 718,000 UGX or an equivalent to $200 |

| 📈 Leverage | 1:500 |

| 📱 Maximum positions per account | 200 |

| 📍 Server Location | New York |

| 💳 Micro trading allowed? | Yes |

| 📉 Currency Pairs | 64 |

| 📊 Index CFD Trading | Yes |

| 📞 Margin Call | 100% |

| 🛑 Stop-out | 50% |

| 👆 One-Click Trading offered? | Yes |

| ☪️ Islamic Accounts | Yes |

| ✔️ Trading Styles accepted | Scalping, hedging, expert advisors, algorithmic trading, etc. |

| 👥 Programming Language | MQL4 |

| ✔️ Suitable for | Expert advisers, scalpers |

| 💵 Demo Account offered? | Yes |

Standard Account

| Account Feature | Value |

| 💻 Trading Platform | MetaTrader 4 and 5 |

| 💸 Commission | None |

| 📊 Typical Average Spreads | 0.6 pips |

| 💵 Minimum Deposit Requirement | 718,000 UGX or an equivalent to $200 |

| 📈 Leverage | 1:500 |

| 📱 Maximum positions per account | 200 |

| 📍 Server Location | New York |

| 💳 Micro trading allowed? | Yes |

| 📉 Currency Pairs | 64 |

| 📊 Index CFD Trading | Yes |

| 📞 Margin Call | 100% |

| 🛑 Stop-out | 50% |

| 👆 One-Click Trading offered? | Yes |

| ☪️ Islamic Accounts | Yes |

| ✔️ Trading Styles accepted | Scalping, hedging, expert advisors, algorithmic trading, etc. |

| 👥 Programming Language | MQL4 |

| ✔️ Suitable for | Discretionary Traders |

| 💵 Demo Account offered? | Yes |

IC Markets Base Account Currencies

➡️ EUR

➡️ USD

➡️ GBP

➡️ AUD

➡️ SGD

➡️ NZD

➡️ JPY

➡️ CHF

➡️ HKD

➡️ CAD

IC Markets Demo Account

IC Markets Islamic Account

How to open an Account with IC Markets

👉 Step 1 – Go to The Official IC Markets Website

➡️ Go to the official IC Markets website (https://www.icmarkets.com/global/en/) and click on “Start Trading”

👉 Step 2 – Fill Out Your Details

➡️ Fill out your personal details such as your first and last name. Now proceed with the steps about yourself, your trading history, and click on “Next” to finish your registration.

Min Deposit

USD 200 / 718,000 UGX

Regulators

ASIC

Trading Desk

Metatrader 4

Crypto

Yes

Total Pairs

65

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

IC Markets Vs NinjaTrader Vs eToro – Broker Comparison

| IC Markets | NinjaTrader | eToro | |

| ⚖️ Regulation | ASIC, CySEC, FSA, SCB | NFA | CySEC, FCA, ASIC, FinCEN, FINRA, SIPC, DNB, FSA |

| 📱 Trading Platform | • MetaTrader 4 • MetaTrader 5 • cTrader | • NinjaTrader Desktop • NinjaTrader Mobile • CQG Mobile | eToro proprietary platform |

| 💰 Withdrawal Fee | None | Yes | Yes |

| 📊 Demo Account | Yes | Yes | Yes |

| 📈 Minimum Deposit | 718,000 UGX | 195,000 UGX | 789,200 UGX |

| 📈 Leverage | 1:500 | 1:50 | 1:400 (Professional) |

| 📊 Spread | From 0.0 pips | 1.1 pips | From 1 pip |

| 💰 Commissions | From $3 to $3.5 | From $0.09 | None |

| ✴️ Margin Call/Stop-Out | 100%/50% | None | None indicated |

| ✴️ Order Execution | Market | Instant, Market | Instant, Market |

| 💳 No-Deposit Bonus | No | No | No |

| 📊 Cent Accounts | No | No | No |

| 📈 Account Types | • cTrader Account • Raw Spread Account • Standard Account | • Forex Account • Futures Account | • Retail Account • Professional Account |

| ⚖️ CMA Regulation | No | No | No |

| 💳 UGX Deposits | No | No | No |

| 📊 Uganda Shilling Account | No | No | No |

| 👥 Customer Service Hours | 24/7 | 24/5 | 24/6 |

| 📊 Retail Investor Accounts | 3 | 2 | 1 |

| ☪️ Islamic Account | Yes | Yes | Yes |

| 📊 Minimum Trade Size | 0.01 lots | 0.01 lots | 0.01 lots |

| 📈 Maximum Trade Size | Unlimited | 100 lots | 100 lots |

IC Markets Trading Platforms

👉 IC Markets offers Ugandan traders a choice between these trading platforms:

➡️ MetaTrader 4

➡️ MetaTrader 5

➡️ cTrader

Desktop Platforms

➡️ MetaTrader 4

➡️ MetaTrader 5

➡️ cTrader

MetaTrader 4

👉 Customers of IC Markets have access to the MetaTrader 4 trading platform, which has won several industry awards. Because of its user-friendliness, feature-packed environment, and capacity for automated trading, MetaTrader 4 (MT4) is without a doubt the most widely used platform for foreign exchange trading in the whole globe.

👉 The MT4 trading platform has developed into a global community where technology suppliers may cater to the requirements of different types of traders.

👉 IC Markets aims to make available to traders in Uganda the most recent version of the MetaTrader 4 platform, which has been developed specifically to assist traders in Uganda in honing their trading methods.

MetaTrader 5

👉 IC Markets is certain that it provides Ugandan traders with all they want for effective market trading thanks to the newly released MetaTrader 5 trading platform.

👉 The better charting technology and order management features of MetaTrader 5 allow traders to monitor and manage their open positions more efficiently.

👉 This allows traders to make more informed trading decisions. It is a powerful trading platform that comes equipped with a plethora of brand-new capabilities that are designed to make the trading experience even more satisfying.

cTrader

👉 Customers are given access to a comprehensive trading platform in the form of cTrader, which is distinguished by its ability to combine the most advantageous aspects of both speed and liquidity. It makes use of proven technology that will make it possible for Ugandan traders to take their trading to an entirely new level.

👉 The cIAgo interface and platform are another one of cTrader’s many innovative features. Utilizing the source code editor together with the programming language C#, it is possible to create individualized technical indications that may be used for technical analysis.

👉 The built-in indicators of cTrader will be supplemented by any custom indicators that are developed by Ugandan users.

WebTrader Platforms

➡️ MetaTrader 4

➡️ MetaTrader 5

➡️ cTrader

MetaTrader 4 and 5

👉 MetaTrader 4 and 5’s WebTrader is an order-placing platform that incorporates MetaTrader’s capabilities while maintaining the speed and accessibility of a web-based application. MetaTrader WebTrader is a web-based trading platform that enables traders to trade in the IC Markets environment without the need for a dealing desk.

👉 On the MetaTrader WebTrader platform, you may engage in trading with just one click, take advantage of small spreads and Level II pricing, and personalize your trader dashboard to keep an eye on open positions.

cTrader

👉 cTrader Web is a program that runs in a web browser and combines the speed and simplicity of web-based software with the order execution capabilities of cTrader. cTrader Web is a user-friendly web-based trading tool that makes trading with IC Markets more straightforward than it has ever been before.

Trading App

➡️ MetaTrader 4

➡️ MetaTrader 5

➡️ cTrader

MetaTrader 4 and 5

👉 Both MetaTrader 4 and MetaTrader 5 are offered as downloadable applications for mobile devices running the Android and iOS operating systems. Because of these applications, traders are thereafter able to access their accounts from any place in the world.

👉 IC Markets’ mobile MetaTrader application takes advantage of the landscape-to-portrait view switcher that is available on iOS and Android devices (a simple rotation of the device).

👉 The MetaTrader mobile application offers these extra capabilities in addition to providing trading with a single click, the ability to customize the interface, and extensive charting and analysis. Traders in Uganda do not need to make any sacrifices in terms of execution speed or quality to get the most out of the IC Markets mobile MetaTrader applications.

cTrader

👉 IC Markets cTrader for Android and iOS is a native piece of software that offers the highest level of Foreign Exchange trading possible. For effective technical analysis, all that is required of traders is to make use of the built-in trend indicators, oscillators, volatility measures, and line drawings inside the chart.

👉 IC Markets gives traders the ability to trade from anywhere in the world because of our low spreads and lightning-fast execution. Traders should anticipate reduced startup times and a more user-friendly interface, like what was available with cTrader Web for Mobile.

IC Markets Range of Markets

👉 Ugandan traders can expect the following range of markets from IC Markets:

➡️ Forex

➡️ Commodities

➡️ Indices

➡️ Bonds

➡️ Cryptocurrencies

➡️ Stocks

➡️ Futures

Broker Comparison for Range of Markets

| IC Markets | NinjaTrader | eToro | |

| ➡️️ Forex | Yes | Yes | Yes |

| ➡️️ Precious Metals | Yes | No | Yes |

| ➡️️ ETFs | No | No | Yes |

| ➡️️ CFDs | Yes | No | Yes |

| ➡️️ Indices | Yes | No | Yes |

| ➡️️ Stocks | Yes | No | Yes |

| ➡️️ Cryptocurrency | Yes | No | Yes |

| ➡️️ Options | No | No | No |

| ➡️️ Energies | Yes | No | Yes |

| ➡️️ Bonds | No | No | No |

Min Deposit

USD 200 / 718,000 UGX

Regulators

ASIC

Trading Desk

Metatrader 4

Crypto

Yes

Total Pairs

65

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

IC Markets Trading and Non-Trading Fees

Spreads

👉 Ugandan traders may pick their own spreads with IC Markets, and the fees they pay will vary depending on the financial instrument being traded, the account type, and the current situation of the market. The following are the average spreads for trading the EUR/USD currency pair:

➡️ cTrader Account – 0.0 pips

➡️ Raw Spread Account – 0.0 pips

➡️ Standard Account – 0.6 pips

Commissions

👉 IC Markets charges fees to account holders with zero-price spread trading accounts to cover their broker’s expenses. Customers in Uganda who register a live trading account with IC Markets should be prepared to pay the following commissions:

➡️ cTrader Account – $3 per side and $6 per round turn

➡️ Raw Spread Account – $3.5 per side and $7 per round turn

👉 In addition, those who use the Islamic Account option that is offered by IC Markets can expect commission charges according to the instrument that they keep open. These charges are indicated in the table below. In addition to the additional commissions, Muslim traders must note that triple charges apply every Friday night to account for the weekend gap.

👉 In addition, Muslim traders who use the Islamic Account must note that IC Markets reserves the right to request additional documentation from traders before approving swap-free privileges.

Overnight Fees, Rollovers, or Swaps

👉 The overnight interest added or removed to keep a trade open overnight is referred to as a swap rate or rollover. The overnight interest rate differentials between the two currencies are considered when determining swap rates for a currency pair.

👉 Traders must remember that if they keep their positions open until the next trading day, they will be charged a fee. Certain financial instruments may have negative swap rates on both sides of the transaction.

👉 Trading platforms employ a point system to calculate swaps, which are subsequently converted into the account base currency. Every financial instrument has its own swap rate, which is measured by the usual lot size of 100,000 units of the base currency. Some of the usual overnight costs charged by IC Markets are as follows:

➡️ EUR/USD – a long swap of 3.9 and a short swap of 0.75

➡️ GBP/USD – a long swap of -1.82 and a short swap of -3.91

➡️ USD/JPY – a long swap of 1.75 and a short swap of -4.6

➡️ XAU/USD – a long swap of -3.5 and a short swap of -0.8

➡️ XAG/USD – a long swap of -0.98 and a short swap of -0.2

➡️ USTEC – a long swap of -1.12 and a short swap of -1.06

➡️ XBR/USD – a long swap of 7.04 and a short swap of -10.9

➡️ XTI/USD – a long swap of 6.01 and a short swap of -8.82

Deposit and Withdrawal Fees

👉 IC Markets does not charge any fees on either deposits or withdrawals. However, Ugandan traders may face processing fees from their payment providers.

Inactivity Fees

👉 IC Markets does not charge any inactivity fees on dormant accounts that are not being used by Ugandan traders.

Currency Conversion Fees

👉 Non-trading fees are not charged by IC Markets, although Ugandan traders could be subject to currency conversion fees if they make deposits in currencies other than AUD, USD, EUR, CAD, GBP, SGD, NZD, JPY, HKD, or CHF.

👉 These are the primary account currencies that are accepted; if deposits or withdrawals are made in UGX, currency conversion fees may apply.

IC Markets Deposits and Withdrawals

➡️ Credit Card

➡️ Debit Card

➡️ PayPal

➡️ Neteller

➡️ Neteller VIP

➡️ Skrill

➡️ UnionPay

➡️ Bank Wire Transfer

➡️ Bpay

➡️ FasaPay

➡️ Broker to Broker

➡️ POLi

➡️ Thai Internet Banking

➡️ Vietnamese Internet Banking

➡️ Rapidpay

➡️ Klarna

How to Deposit Funds with IC Markets

➡️ To deposit money into an IC Markets account, traders must first connect to their trading account and then choose a deposit method and currency.

➡️ Following that, traders can indicate the amount they want to deposit and carry out any additional steps required by their payment provider to finalize and complete the deposit.

IC Markets Fund Withdrawal Process

➡️ Ugandans can log into their Client Area and access the option to withdraw funds from the dashboard.

➡️ Traders can complete the withdrawal request by selecting the account from where the withdrawal will be made, indicating the amount, and choosing the withdrawal method.

➡️ Traders must note that withdrawal requests that are submitted before noon AEST/AEDT will be processed the next business day.

IC Markets Education and Research

Education

IC Markets offers the following Educational Materials:

➡️ Trading Knowledge

➡️ Advantages of Forex

➡️ Advantages of CFDs

➡️ Video Tutorials

➡️ Web TV

➡️ Webinars

➡️ Podcasts

➡️ Getting Started – which contains 10 lessons

➡️ Economic Calendar

➡️ Market Analysis Blog

➡️ Forex Calculators

➡️ Forex Glossary

IC Markets Bonuses and Promotions

How to open an Affiliate Account with IC Markets

➡️ Ugandans can navigate to the IC Markets website and locate the “Partners” link at the top of the homepage.

➡️ A new page will load, and prospective affiliates can read through IC Markets’ offering.

➡️ Prospective affiliates can select the green “Join Now” banner to get started on their application.

➡️ Prospective affiliates can complete the application with the relevant and required information and submit it for review by IC Markets.

➡️ The turnaround time for feedback is typically one business day and once approved, an IC Markets team member will advise the new affiliate on how they can start referring clients.

IC Markets Affiliate Program Features

➡️ Access to the greatest trading results.

➡️ The capacity to grow a company while also helping clients.

➡️ Converting leads with IC Markets’ skilled assistance.

➡️ Gain access to the potential to grow your company.

➡️ Receive financial advice and support from a professional affiliate team.

➡️ Maintain a competitive advantage.

➡️ Receive comprehensive reports and insights.

➡️ Use IC Markets to have access to flexible finance choices.

IC Markets Customer Support

IC Markets Corporate Social Responsibility

Verdict on IC Markets

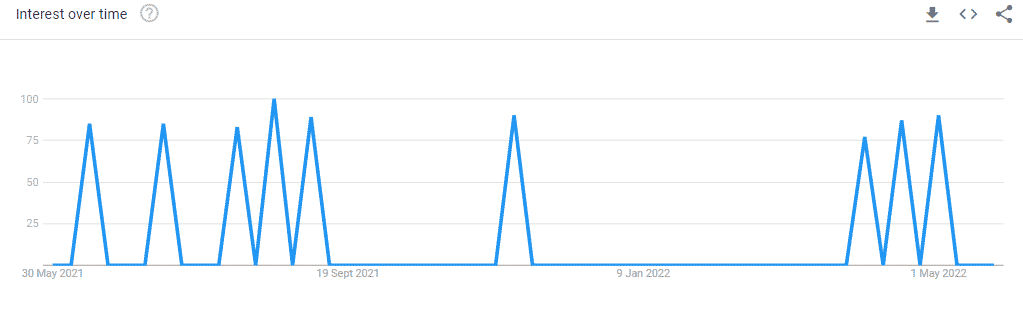

IC Markets Current Popularity Trends

👉 According to Google Trends, IC Markets has seen an increase in Google Searches in the past month.

Min Deposit

USD 200 / 718,000 UGX

Regulators

ASIC

Trading Desk

Metatrader 4

Crypto

Yes

Total Pairs

65

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

IC Markets Pros and Cons

| ✔️ Pros | ❌ Cons |

| IC Markets has a high trust score of 85 out of 100 with regulations through four market regulators | There is no UGX-denominated account and UGX is not an accepted deposit or withdrawal currency which means that currency conversion fees are charged |

| Ugandan traders can choose from three account types which are hosted on cTrader, MetaTrader 4, and MetaTrader 5 | There is no proprietary trading platform offered to Ugandans |

| There are free deposits and withdrawals offered through a plethora of payment methods | Fixed spread accounts are not offered by IC Markets |

| There are instant deposits and withdrawals offered to Ugandans | |

| IC Markets does not apply an inactivity fee on dormant accounts | |

| There is a True ECN model that ensures that Ugandans can expect the best possible pricing | |

| There is a demo account and an Islamic account provided | |

| The account registration for a real account is quick and hassle-free |

Frequently Asked Questions

Is IC Markets a true ECN?

Yes, IC Markets is one of few true ECN brokers that source some of the best liquidity sourced from 25 trusted liquidity providers.

Can I trade gold on IC Markets?

Yes, trading the spot price of metals such as gold or silver against the United States Dollar or the Euro is possible through IC Markets. Additionally, trading the spot price of platinum or palladium against the United States Dollar as a currency pair is possible through IC Markets.

Is IC Markets regulated?

Yes, IC Markets is well-regulated by these market regulators in Australia, Cyprus, Seychelles, and the Bahamas:

- Australian Securities and Investments Commission (ASIC)

- Cyprus Securities and Exchange Commission (CySEC)

- Financial Services Authority (FSA)

- Securities Commission of the Bahamas (SCB)

Is IC Markets halal?

Yes, IC Markets offers Islamic trading conditions.

Customers who, according to their religious views, are unable to either earn or pay interest can take advantage of the Islamic accounts offered by IC Markets.

These accounts are also known as swap-free accounts. On the cTrader, Raw Spread and Standard account types, as well as on the MT4, MT5, and cTrader trading platforms, you can trade without being charged swap fees.

What is the withdrawal time for IC Markets?

Withdrawals with IC Markets can either be instant or they can take up to 14 days as follows:

- PayPal, Neteller, Neteller VIP, Skrill, UnionPay – Instant

- Thai and Vietnamese Internet Banking – One business days

- Bpay, POLi – 2 to 3 business days

- Debit/Credit Cards, FasaPay, Broker to Broker, Rapidpay, Klarna – 3 to 5 business days

- Bank Wire Transfer – up to 14 business days

Does IC Markets have Nasdaq?

Yes, Nasdaq is an available CFD with IC Markets.

Does IC Markets have a UGX Account?

No, IC Markets only offers trading accounts with base currencies in AUD, USD, EUR, CAD, GBP, SGD, NZD, JPY, HKD, or CHF.

Does IC Markets have Volatility 75?

Yes, VIX is an available financial instrument that can be traded as a Futures CFD.

Is IC Markets safe or a scam?

IC Markets is a safe broker. This conclusion is based on the verified regulatory status, the client fund segregation and anti-money laundering procedures, KYC requirements, and the overall trading environment provided by IC Markets.

Conclusion

➡️ Do you have any prior experience with IC Markets?

➡️ What was the determining factor in your decision to engage with IC Markets?

➡️ Was it because of the minimum deposit, regulation, retail trading accounts, or any other factors?

➡️ Have you experienced any issues with IC Markets such as difficulty withdrawing funds, inability to verify regulations, irresponsive customer support, etc.?

Addendum/Disclosure:

Table of Contents