FP Markets Review

Overall, FP Markets is considered low-risk, with an overall Trust Score of 82 out of 100. FP Markets is licensed by one Tier-1 Regulator (high trust), one Tier-2 Regulator (average trust), and zero Tier-3 Regulators (low trust). FP Markets offers four different retail trading accounts namely an MT4/5 Standard Account, MT4/5 Raw Account, MT4/5 Islamic Standard Account, and a MT 4/5 Islamic Raw Account. FP Markets is currently not regulated by the CMA of Uganda

- Louis Schoeman

Jump to:

Regulation and Safety of Funds

Account Types and Features

Account Registration

Trading Platforms

Range of Markets

Fees

Deposits and Withdrawals

Education and Research

Affiliate Program

Final Verdict

Pros and Cons

FAQ

Min Deposit

USD 100 / 250,000 UGX

Regulators

ASIC, CySEC, FSCA, CMA

Trading Desk

MetaTrader 4, MetaTrader 5

Crypto

Yes

Total Pairs

63

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

FP Markets Review – 25 key points quick overview:

FP Markets Overview

FP Markets At a Glance

FP Markets Regulation and Safety of Funds

- FP Markets Awards and Recognition

- FP Markets Account Types and Features

- How to open an Account with FP Markets

- FP Markets Vs AvaTrade Vs OANDA – Broker Comparison

- FP Markets Trading Platforms

- FP Markets Range of Markets

- Broker Comparison for Range of Markets

- FP Markets Trading and Non-Trading Fees

- FP Markets Deposits and Withdrawals

- How to Deposit Funds with FP Markets

- FP Markets Fund Withdrawal Process

- FP Markets Education and Research

- FP Markets Bonuses and Promotions

- How to open an Affiliate Account with FP Markets

- FP Markets Affiliate Program Features

- FP Markets Customer Support

- FP Markets Corporate Social Responsibility

- Verdict on FP Markets

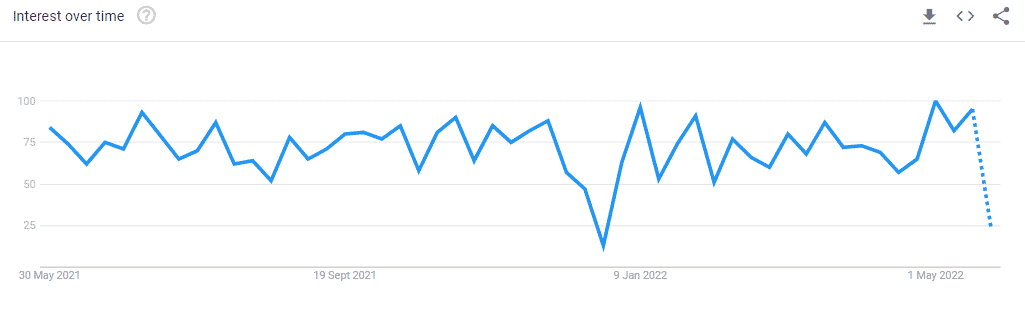

- FP Markets Current Popularity Trends

- FP Markets Pros and Cons

- Frequently Asked Questions

- Conclusion

FP Markets Overview

FP Markets Distribution of Traders

👉 FP Markets currently has the largest market share in these countries:

➡️️ Italy – 14.3%

➡️️ India – 13.1%

➡️️ Australia – 12.2%

➡️️ United Kingdom – 5.6%

➡️️ Spain – 5.5%

Popularity among traders who choose FP Markets

🥇 The broker, FP Markets, does not have a dominating position in the Ugandan forex business, yet it is regarded as one of the top 30 forex brokers for Ugandan investors despite this fact.

FP Markets At a Glance

| 🏛 Headquartered | Australia |

| 🏙 Local office in Kampala? | No |

| ✅ Accepts Uganda traders? | Yes |

| 🗓 Year Founded | 2005 |

| 📞 Uganda Office Contact Number | None |

| 🤳 Social Media Platforms | • Facebook • YouTube • Telegram |

| ⚖️ Regulation | ASIC, CySEC, FSCA, CMA |

| 🪪 License Number | • Australia – ABN 16112600281 • Cyprus – 371/18 |

| ⚖️ CMA Uganda Regulation | None |

| 🚫 Regional Restrictions | United States, Japan, New Zealand |

| ☪️ Islamic Account | Yes |

| 💻 Demo Account | Yes |

| 🛍 Retail Investor Accounts | 7 |

| 📊 PAMM Accounts | Yes |

| 🤝 Liquidity Providers | Barclays, BNP Paribas, Commerzbank, Credit Suisse, Goldman Sachs |

| 💸 Affiliate Program | Yes |

| 📲 Order Execution | Market |

| 📊 Average spread | 0.0 pips |

| 📞 Margin Call | 100% |

| 🛑 Stop-Out | 50% |

| ✅ Crypto trading offered? | Yes |

| 💰 Offers a UGX Account? | No |

| 👨💻 Dedicated Uganda Account Manager? | No |

| 📊 Maximum Leverage | 1:500 |

| 🚫 Leverage Restrictions for Uganda? | No |

| 💰 Minimum Deposit | 250,000 UGX or an equivalent to AU$100 |

| ✅ Uganda Shilling Deposits Allowed? | Yes |

| 📊 Active Uganda Trader Stats | 100,000+ |

| 👥 Active Uganda-based FP Markets customers | Unknown |

| 💳 Uganda Daily Forex Turnover | Unknown, overall Forex Daily Trading Volume is over $6.6 Trillion |

| 💵 Deposit and Withdrawal Options | SticPay, PerfectMoney, DragonPay, Rupee, Pagsmile, Rapyd, Rapid, XPay, Finrax, LetKnowPay, LuqaPay, PayRetailers, ApplePay, GooglePay, VirtualPay |

| 🏦 Segregated Accounts with Uganda Banks? | No |

| 📊 Trading Platforms | • MetaTrader 4 • MetaTrader 5 • WebTrader • Myfxbook AutoTrade • FP Markets App |

| ✔️ Tradable Assets | • Forex • Shares • Metals • Commodities • Indices • Cryptocurrencies • Bonds • ETFs |

| 💸 Offers USD/UGX currency pair? | No |

| 📈 USD/UGX Average Spread | N/A |

| 📉 Offers Uganda Stocks and CFDs | None |

| 🗣 Languages supported on Website | English, Arabic, German, Portuguese, Vietnamese, Indonesian, French, Malay, Italian, Russian |

| 📞 Customer Support Languages | Multilingual |

| ⏰ Customer Service Hours | 24/7 |

| 👥 Uganda-based customer support? | No |

| ✅ Bonuses and Promotions for Uganda traders | None |

| 📚 Education for Uganda beginner traders | Yes |

| 📱 Proprietary trading software | Yes |

| 💰 Most Successful Ugandan Trader | Unknown |

| ✅ Is FP Markets a safe broker for Ugandan traders? | Yes |

| 📊 Rating for FP Markets Uganda | 9/10 |

| 🤝 Trust score for FP Markets Uganda | 81% |

| 👉 Open an account | 👉 Open Account |

FP Markets Regulation and Safety of Funds

FP Markets Regulation in Uganda

FP Markets Global Regulations

FP Markets Client Fund Security and Safety Features

FP Markets Awards and Recognition

FP Markets Account Types and Features

➡️ MT4/5 Standard Account

➡️ MT4/5 Raw Account

➡️ MT4/5 Islamic Standard Account

➡️ MT4/5 Islamic Raw Account

Live Trading Accounts

MT4/5 Standard Account

| Account Feature | Value |

| 💰 Minimum Deposit | 250,000 UGX or an equivalent to AU$100 |

| 📊 Average Spreads | Variable, from 1 pip |

| ✔️ Instruments Available | 60+ Forex pairs, metals, indices, commodities |

| 📈 Maximum Leverage Ratio | 1:500 |

| 📱 Execution Type | ECN |

| 💵 Commissions | None |

| 👥 Expert Advisors Offered? | Yes |

| 📲 Mobile App Offered? | Yes |

| ✔️ VPS Available? | Yes |

MT4/5 Raw Account

| Account Feature | Value |

| 💰 Minimum Deposit | 250,000 UGX or an equivalent to AU$100 |

| 📊 Average Spreads | Variable, from 0.0 pips |

| ✔️ Instruments Available | 60+ Forex pairs, metals, indices, commodities |

| 📈 Maximum Leverage Ratio | 1:500 |

| 📱 Execution Type | ECN |

| 💵 Commissions | US$3 per side |

| 👥 Expert Advisors Offered? | Yes |

| 📲 Mobile App Offered? | Yes |

| ✔️ VPS Available? | Yes |

MT4/5 Islamic Standard Account

| Account Feature | Value |

| 💰 Minimum Deposit | 250,000 UGX or an equivalent to AU$100 |

| 📊 Average Spreads | Variable, from 1 pip |

| ✔️ Instruments Available | 60+ Forex pairs, metals, indices, commodities |

| 📈 Maximum Leverage Ratio | 1:500 |

| 📱 Execution Type | ECN |

| 💵 Commissions | None |

| 👥 Expert Advisors Offered? | Yes |

| 📲 Mobile App Offered? | Yes |

| ✔️ VPS Available? | Yes |

MT4/5 Islamic Raw Account

| Account Feature | Value |

| 💰 Minimum Deposit | 250,000 UGX or an equivalent to AU$100 |

| 📊 Average Spreads | Variable, from 1 pip |

| ✔️ Instruments Available | 60+ Forex pairs, metals, indices, commodities |

| 📈 Maximum Leverage Ratio | 1:500 |

| 📱 Execution Type | ECN |

| 💵 Commissions | US$3 per side |

| 👥 Expert Advisors Offered? | Yes |

| 📲 Mobile App Offered? | Yes |

| ✔️ VPS Available? | Yes |

FP Markets Base Account Currencies

FP Markets Demo Account

FP Markets Islamic Account

How to open an Account with FP Markets

👉 It is simple to establish an account with FP Markets since the procedure is digital and straightforward to follow. Additionally, the application is processed and approved on the same day or within 1-2 business days, allowing you to begin trading as soon as possible.

👉 To register an account with FP Markets, Ugandan traders can follow these steps:

👉 Step 1 – Go to the official FP Markets website

➡️ Go to the official FP Markets website and click on “Quick Start”. Now click on “Open Live” or “Try Demo”, whichever account you want to open.

👉 Step 2 – Fill Out Your Details

➡️ Now fill out your personal details such as email, first and last name, country of residence, and gender.

👉 Step 3 – Verify Your Account

➡️ You can now verify your account by clicking on the link sent to your email address. Once verified you can now trade with your account.

Min Deposit

USD 100 / 250,000 UGX

Regulators

ASIC, CySEC, FSCA, CMA

Trading Desk

MetaTrader 4, MetaTrader 5

Crypto

Yes

Total Pairs

63

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

FP Markets Vs AvaTrade Vs OANDA – Broker Comparison

| FP Markets | AvaTrade | OANDA | |

| ⚖️ Regulation | ASIC, CySEC | Central Bank of Ireland (CBI), BVI FSC, ASIC, FSCA, JFSA, FFAJ, ADGM, FRSA, CySEC, ISA | IIROC, ASIC, CFTC, NFA, FCA, FFAJ, MAS, MFSA |

| 📱 Trading Platform | • MetaTrader 4 • MetaTrader 5 • WebTrader • Myfxbook AutoTrade • FP Markets App | • AvaTradeGO • AvaOptions • AvaSocial • MetaTrader 4 • MetaTrader 5 • DupliTrade • ZuluTrade | • MetaTrader 4 • MetaTrader 5 • OANDA Web • OANDA Mobile |

| 💰 Withdrawal Fee | Yes | No | None |

| 📊 Demo Account | Yes | Yes | Yes |

| 📈 Minimum Deposit | 250,000 UGX | 377,000 UGX | 0 UGX |

| 📈 Leverage | 1:500 | 1:400 | 1:200 |

| 📊 Spread | 0.0 pips | Fixed, from 0.9 pips | Variable, from 0.1 pips |

| 💰 Commissions | From US$3 | None | 40 USD |

| ✴️ Margin Call/Stop-Out | 100%/50% | 25%/10% | Stop-out of 50% |

| ✴️ Order Execution | Market | Instant | Market |

| 💳 No-Deposit Bonus | No | No | No |

| 📊 Cent Accounts | No | No | No |

| 📈 Account Types | • MT4/5 Standard Account • MT4/5 Raw Account • MT4/5 Islamic • Standard Account • MT4/5 Islamic Raw Account | • Standard Live Account • Professional Account Option | • Standard Account Core Account • Swap-Free Account |

| ⚖️ CMA Regulation | None | No | No |

| 💳 UGX Deposits | Yes | No | Yes |

| 📊 Uganda Shilling Account | No | No | No |

| 👥 Customer Service Hours | 24/7 | 24/5 | 24/5 |

| 📊 Retail Investor Accounts | 4 | 1 | 3 |

| ☪️ Islamic Account | Yes | Yes | Yes |

FP Markets Trading Platforms

👉 FP Markets offers Ugandan traders a choice between these trading platforms:

➡️ MetaTrader 4

➡️ MetaTrader 5

➡️ WebTrader

➡️ Myfxbook AutoTrade

➡️ FP Markets App

Desktop Platforms

➡️ MetaTrader 4

➡️ MetaTrader 5

MetaTrader 4

👉 MetaTrader 4 is a popular choice among forex traders in Namibia because it provides real-time market pricing and speedy transaction execution.

👉 Aside from that, FP Markets offers advanced charting tools, a diverse collection of technical indicators, as well as the most recent market news and technical analysis, all accessible via the desktop interface, guaranteeing that Ugandan consumers enjoy an exceptional trading experience.

MetaTrader 5

👉 MetaTrader 5 is a multi-asset trading platform designed specifically for forex and contract for difference (CFD) trading. Trading in Forex, stocks, metals, commodities, indices, and cryptocurrencies is a breeze when using the MT5 platform from FP Markets, which is available for Windows, Linux, and macOS X.

WebTrader Platforms

➡️ MetaTrader 4

➡️ MetaTrader 5

➡️ Myfxbook AutoTrade

MetaTrader 4

👉 With MetaTrader 4, the trading platform may be accessed from any computer or mobile device that has a web browser installed. WebTrader is a web-based trading platform that is available for both Windows and Mac users who want to trade using web browsers such as Google Chrome.

👉 The use of a strong programming language makes it easy to develop automated trading strategies that can be implemented instantaneously using the MetaTrader 4 platform.

👉 No other platform can compete with the easy, customisable user experience of MetaTrader online when it comes to foreign currency conversion and trading.

MetaTrader 5

👉 MetaTrader 5 has the added benefit of providing a great degree of adaptability. FP Markets is compatible with a variety of operating systems, including Mac OS. Any major web browser may be used to access WebTrader, a web-based trading platform.

👉 It is a satisfactory solution for Ugandan traders who use EAs like AutoChartist to trade on MetaTrader 5 with FP Markets’ fast execution and cheap spreads. Forex and CFD traders may improve their accuracy by using automated trading systems like AutoTrade.

👉 Customers of FP Markets can easily connect to the MetaTrader 5 platform through WebTrader, giving them a wide range of options. Ugandans do not need to download or install any software to trade from any browser.

Myfxbook AutoTrade

👉 Mirroring service for foreign exchange transactions There is no disputing the fact that AutoTrade is the finest in the industry. Customers of FP Markets may use advanced copy trading techniques to replicate traders with a proven track record.

👉 MetaTrader 4 (MT4) live account users of FP Markets may use the AutoTrade tool to look at the prior performance of trading strategies and then reproduce them in their accounts. Because AutoTrade is specifically designed for the MetaTrader 4 trading platform, it is ideal for scalping.

👉 A configurable user interface and outstanding trading statistics are just two of the many features available in Myfxbook AutoTrade.

Trading App

➡️ MetaTrader 4

➡️ MetaTrader 5

➡️ FP Markets App

MetaTrader 4 and 5

👉 The software for smartphones has evolved as the devices have become more popular. Mobile trading versions of MT4 may be downloaded from the App Store and Google Play for both Android and iOS devices. Forex traders may easily access the global market on their iPhones, iPads, and other application-based devices.

👉 Additionally, Ugandan traders may do market research on the MetaTrader 5 trading program website, which is growing in functionality. Lastly, comprehensive charting and technical analysis tools are included, as well as currency indicators and better pending order capabilities.

FP Markets App

👉 FP Markets also provides Ugandan traders access to its proprietary Android and iOS app for trading forex, commodities, commodities indexes, equity indices, futures, and cryptocurrencies. With the FP Markets app, Ugandan traders have access to a wide variety of instruments, the greatest functionality, a variety of features, and more.

FP Markets Range of Markets

👉 Ugandan traders can expect the following range of markets from FP Markets:

➡️ Forex

➡️ Shares

➡️ Metals

➡️ Commodities

➡️ Indices

➡️ Cryptocurrencies

➡️ Bonds

Broker Comparison for Range of Markets

| FP Markets | AvaTrade | OANDA | |

| ➡️️ Forex | Yes | Yes | Yes |

| ➡️️ Precious Metals | Yes | Yes | Yes |

| ➡️️ ETFs | No | Yes | No |

| ➡️️ CFDs | Yes | Yes | Yes |

| ➡️️ Indices | Yes | Yes | Yes |

| ➡️️ Stocks | Yes | Yes | Yes |

| ➡️️ Cryptocurrency | Yes | Yes | No |

| ➡️️ Options | No | Yes | No |

| ➡️️ Energies | Yes | Yes | Yes |

| ➡️️ Bonds | No | Yes | Yes |

Min Deposit

USD 100 / 250,000 UGX

Regulators

ASIC, CySEC, FSCA, CMA

Trading Desk

MetaTrader 4, MetaTrader 5

Crypto

Yes

Total Pairs

63

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

FP Markets Trading and Non-Trading Fees

Spreads

👉 Spreads offered by FP Markets will vary by account type and financial instrument. With variable spreads, traders can anticipate changes according to certain factors along with the overall market circumstances throughout the trading day, which may lead spreads to grow or fall.

👉 FP Markets’ typical spreads are as follows:

➡️ MT4/5 Standard Account – 1 pip EUR/USD

➡️ MT4/5 Raw Account – 0.0 pips EUR/USD

➡️ MT4/5 Islamic Standard Account – 1 pip EUR/USD

➡️ MT4/5 Islamic Raw Account – 0.0 pips EUR/USD

Commissions

👉 Commissions are a fixed cost that FP Markets charges for facilitating deals. The typical commission rates are as follows:

➡️ MT4/5 Raw Account – US$3 per side

➡️ MT4/5 Islamic Raw Account – US$3 per side

Overnight Fees, Rollovers, or Swaps

👉 FP Markets displays all exchange costs for each instrument on their website, which is a positive demonstration of openness. To calculate swap costs, FP Markets uses the current bank interest rates plus a modest markup to account for facilitating the trade.

👉 With regards to computing overnight fees, the trading platforms’ timestamp is used by FP Markets, which implements these fees at the stroke of midnight. Overnight fees are only applied to positions that have been open for more than 24 hours, and they can be either negative or positive based on the interest rate difference between the two currencies.

👉 Investors in certain currency pairings should keep an eye on the likelihood of negative exchange rates. Instead of having traders worry about swap calculation, MetaTrader 4 and 5 take care of it automatically.

👉 As part of FP Markets’ overnight cost calculation, they use a standard lot size of 100,000 base units for each currency pair. Ugandan traders who trade through FP Markets can expect the following overnight fees:

➡️ EUR/USD – a long swap of -5.50 and a short swap of 0.38

➡️ BTC/USD – a long swap of -20.00 and a short swap of -20.00

➡️ US100 – a long swap of -1.07 and a short swap of -0.94

➡️ XAG/USD – a long swap of -1.36 and a short swap of -0.78

➡️ XAU/USD – a long of -4.88 and a short swap of -1.82

Deposit and Withdrawal Fees

👉 There are no costs for Ugandan traders to open a trading account with FP Markets. However, costs for withdrawals are outlined in this manner:

➡️ International Bank Wire other than AUD – 10 AUD

➡️ Neteller – 2% up to 30 USD in addition to country fees

➡️ Skrill – 1% and country fees

➡️ Fasapay – 0.50%

➡️ PayTrust – 1.5%

➡️ Dragonpay – 1.5%

➡️ Perfect Money – 0.5%

➡️ Asian, African, and Latam Payments – 2%

➡️ Cryptocurrency Payments – Blockchain fees

➡️ MPSA – 7.25%

➡️ FairPay – 0.5% plus an additional flat fee of 10 USD

➡️ Paylivre – 1.5%

➡️ Finrax – Blockchain fees

➡️ Sticpay – 5% for bank wire and 2.5% for wallet fees

➡️ Thai Pay – 0.5%

Inactivity Fees

👉 A positive thing about FP Markets is that there is no inactivity fee, so if you do not use your account for an extended period, you will not face any fees or penalties.

Currency Conversion Fees

FP Markets Deposits and Withdrawals

👉 Ugandan traders can choose from these deposit methods to fund the trading account:

➡️ Debit Card

➡️ Bank Transfer

➡️ Neteller

➡️ Skrill

➡️ PayTrust

➡️ Sticpay

➡️ Fasapay

➡️ Virtual Pay

➡️ Rupee Payments

➡️ Dragonpay

➡️ Perfect Money

➡️ Asian, African and Latam Payments

➡️ Paylivre

➡️ Cryptocurrency (LetKnowPay)

➡️ Rapyd Bank Transfer

➡️ Rapid Transfer

➡️ Finrax

➡️ MPSA

➡️ Nganluong

➡️ XPAY

➡️ Broker to Broker

👉 When withdrawing funds from a trading account, Ugandan traders can choose from these methods:

➡️ Debit Card

➡️ Credit Card

➡️ Domestic Bank Wire

➡️ International Bank Wire

➡️ Neteller

➡️ Skrill

➡️ Fasapay

➡️ PayTrust

➡️ Dragonpay

➡️ Perfect Money

➡️ Cryptocurrency

➡️ MPSA

➡️ FairPay

➡️ Paylivre

➡️ Finrax

➡️ Sticpay

➡️ Rupee Payments

➡️ Rapid

➡️ Virtual Pay

➡️ XPAY

How to Deposit Funds with FP Markets

👉 To deposit funds to an account with FP Markets, Ugandan traders can follow these steps:

➡️ Select the “Funding” option on the left side of your screen in the secure Client Area to deposit funds.

➡️ You then choose the retail trading account you want to finance by clicking “Deposit.”

➡️ To make a deposit, you can choose a payment method, input a deposit amount, and select the deposit currency.

➡️ Lastly, you can complete any additional actions as per the payment provider that you chose to use.

FP Markets Fund Withdrawal Process

👉 To withdraw funds from an account with FP Markets, Ugandan traders can follow these steps:

➡️ Log into the Client Area and click “Funding,” then “Withdraw,” and fill out the request form to withdraw funds. Note that traders may only utilize a different method to withdraw the earnings of their deposits have been withdrawn. Traders should be aware of this rule.

➡️ There is a limit on how much a trader may take from their account if they have deposited 1,100 NAD by credit or debit card. Similarly, if the trader uses a bank wire transfer to deposit monies, they must withdraw those funds to the same bank account.

➡️ Traders who fund their trading accounts in several ways must return the same amount to each source of payment, with credit card payments having precedence.

➡️ As soon as the first deposits are removed, traders may make the remaining withdrawals in a similar sequence to how they deposited money into their trading accounts.

➡️ Traders may then use any of the other financing options, subject to FP Markets’ permission, to withdraw their trading account winnings.

FP Markets Education and Research

Education

➡️ Trading Courses Videos

➡️ Webinars

➡️ Podcasts

➡️ Events

➡️ Platform Video Tutorials

➡️ eBooks

➡️ Glossary

➡️ Newsletter

➡️ FP Markets Academy

➡️ Trader’s Hub

➡️ Trading Knowledge

➡️ Technical Analysis

➡️ Fundamental Analysis

➡️ Economic Calendar

➡️ Forex Calculator

➡️ Traders Hub Blog

FP Markets Bonuses and Promotions

How to open an Affiliate Account with FP Markets

➡️ Visit the official FP Markets website and hover over “Partners” from the homepage.

➡️ Click on the option and wait for the new page to load.

➡️ Click on the red “Join Now” banner and select “Affiliate” from the dropdown list of options.

➡️ Provide your first and last name, valid email address, country of residence, and mobile number.

➡️ Next, provide a Username and user-selected password.

➡️ Next, indicate how you will promote FP Markets either through your website, social media, as a signal provider, Google, PPC, or any other way.

➡️ Specify your social medial links and website URLs.

➡️ Indicate whether you are an affiliate with other brokers and indicate the number of clients that you refer monthly.

➡️ Select your expected total deposits from the options and indicate how long you have been an affiliate (if you are an existing affiliate with other brokers).

➡️ Indicate the regions that you are targeting.

➡️ Lastly, read and agree to the Affiliate Terms and Conditions and click on “Apply Now” to apply.

FP Markets Affiliate Program Features

➡️ Technology that provides real-time data tracking

➡️ 24/7 advanced reporting

➡️ Unlimited access to dedicated conversion specialists

➡️ Multilingual marketing tools

➡️ Flexible payment structures

➡️ Multiple payment options

➡️ Lucrative commissions that can be earned from FP Market’s Introducing Broker and Affiliate portal

FP Markets Customer Support

FP Markets Corporate Social Responsibility

Verdict on FP Markets

FP Markets Current Popularity Trends

👉 According to Google Trends,FP Markets has seen an increase in Google Searches in the past month.

Min Deposit

USD 100 / 250,000 UGX

Regulators

ASIC, CySEC, FSCA, CMA

Trading Desk

MetaTrader 4, MetaTrader 5

Crypto

Yes

Total Pairs

63

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

FP Markets Pros and Cons

| ✔️ Pros | ❌ Cons |

| FP Markets offers high investor protection through CySEC as well as Tier-1 ASIC regulation | Additional admin fees apply to Islamic account trading |

| There are competitive spreads and commissions | There are withdrawal fees which are charged on several payment providers |

| Account registration is quick and seamless with FP Markets | |

| There are a few account options to choose from depending on the trader’s needs, objectives, and level of trading expertise | |

| There are unlimited demo accounts offered | |

| There are two designated Islamic accounts for Muslim traders | |

| There is a choice between powerful trading platforms and advanced tools | |

| There are education materials offered and FP Markets provides trading tools to advanced traders |

Frequently Asked Questions

Is FP Markets regulated?

Yes, FP Markets is regulated. In Australia, FP Markets is regulated by ASIC under AFSL number 286354 with ABN 16112600281. In Cyprus, FP Markets is well-regulated through CySEC under license number 371/18.

Is FP Markets a Market Maker?

No, FP Markets is not a Market Maker but an ECN and STP No-Dealing Desk (NDD) forex and CFD broker.

What can you trade with FP Markets?

At FP Markets, you may trade CFDs on a wide range of financial instruments, including Forex, stocks, metals, indices, commodities, and bonds. FP Markets has more than 10,000 CFD products to choose from throughout the world’s major financial markets.

What is the withdrawal time for FP Markets?

When you use the Sticpay wallet, your withdrawals will be processed instantly. With all other payment options, it can take between 1 business day up to 5 working days.

Is FP Markets available in the USA?

No, FP Markets does not offer its services or solutions to United States clients because of strict regulations.

Does FP Markets have Nasdaq?

Yes, FP Markets offers some popular indices that can be traded, including Nasdaq.

Does FP Markets have Volatility 75?

Yes, FP Markets offers access to the Volatility 75 index (VIX) that can be traded through MetaTrader 4 or MetaTrader 5.

Does FP Markets have negative balance protection?

Yes, FP Markets provides negative balance protection to traders who register an account under CySEC.

Is FP Markets safe or a scam?

FP Markets is safe. FP Markets has a high trust score and a high level of trustworthiness. All client funds are protected, and FP Markets offers investor protection, negative balance protection, and several other tools.

Conclusion

➡️ Do you have any prior experience with FP Markets?

➡️ What was the determining factor in your decision to engage with FP Markets?

➡️ Was it because of the minimum deposit, regulation, retail trading accounts, or any other factors?

➡️ Have you experienced any issues with FP Markets such as difficulty withdrawing funds, inability to verify regulations, irresponsive customer support, etc.?

Addendum/Disclosure:

Table of Contents